In this issue:

GDP growth forecasts.

The stimulus of China.

Economic indices: the U.S., the Eurozone and China

The world of Trump II

Economy

Geopolitics

Forecasts of policies and developments under President Trump.

Conclusions: Pros and cons of Trump II

GDP Forecasts

Our nowcasts (nc) are currently indicating that the U.S. economy would have grown at a robust, 0.8% (3.2% annualized) pace during the last quarter of past year.1 The growth of the Eurozone would have also continued at a decent pace. Nowcasts of both of these countries/regions improved from past month. However, our nowcasts are now indicating that the Finnish economy would have shrunk during Q4

We are currently expecting that growth would wane this year due to a wide-variety of shocks and uncertainties. We are expecting that banking issues re-emerge during Q2 caused by certain sectors of the U.S. economy falling into recession, and due to growing uncertainty in the wake of government spending curbs enacted by the administration of President Trump. These spill over to Europe, where uncertainty is also growing due bitter in-fighting within the EU considering policies over Ukraine and Russia. We expect the banking problems to be short-lived, but the withdrawing fiscal stimulus in Europe and in the U.S. leads to declining economic momentum during the latter part of the year.

Note that we are now forecasting a more positive growth outcome for this year than we did in our Optimistic scenario. This is, because we have re-evaluated the policies of President Trump, most notably the trajectory of fiscal stimulus (see below).

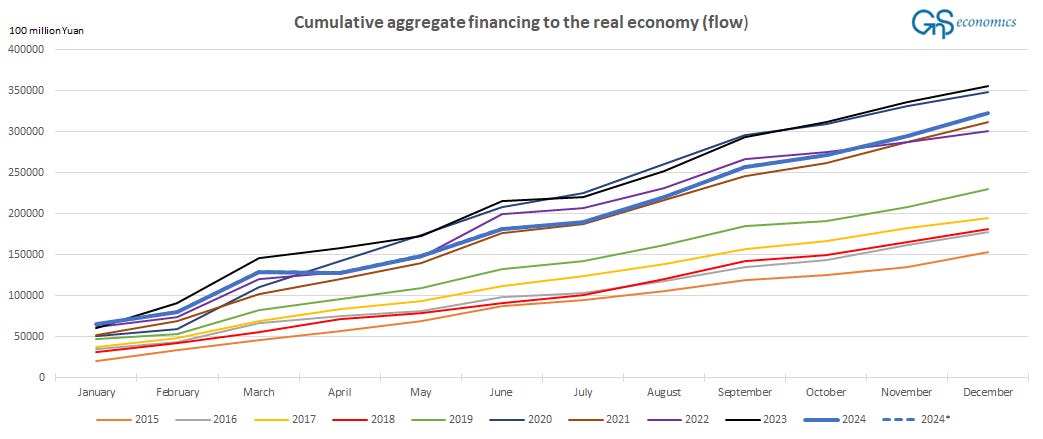

The stimulus of China

Bang! The flow of aggregate financing into the Chinese economy grew by RBM2.851 trillion in December, a notable increase from past year’s RMB1.940 trillion. Our past month’s forecast indicated that the December flow of financing would have been RMB1.729 trillion. A considerable miss. The flow of financing into the Chinese economy totaled RMB32.325 trillion in 2024, while our last forecast from December was RMB31.2 trillion. In 2023, the total inflow was RMB35.569 trillion making it the most stimulus-heavy year in China, ever.

It seems that Beijing wanted to end the year with a bang. It is interesting to see what ‘tune’ Beijing will be playing this year. We are suspecting that stimulus will be heavy during the first months of the year, because Beijing does not want the economy to tank going into the trade-brawl with President Trump. Therefore we keep expecting major Chinese stimulus and thus an improving global economic momentum for H1.

Economic Indicators

United States, January (December)

Richmond Fed manufacturing: -4 (-10)

Empire State manufacturing: -12.6 (0.2)

Dallas Fed manufacturing: 12.2 (3.9)

Kansas Fed manufacturing: -5 (-5)

Manufacturing PMI:2 50.1 (49.4)

Services PMI: 52.8 (56.8)

Consumer Confidence:3 104.7 (112.8)

U.S. leading indicator; December (November):4 101.6 (101.7)

Eurozone, January (December)

Manufacturing PMI: 46.1 (45.1)

Services PMI: 51.4 (51.6)

Germany ifo Business Climate:5 85.1 (84.7) (A first uptick since October.)

China, December (November)

Caixin manufacturing PMI: 50.5 (51.5)

NBS manufacturing PMI; January (December): 49.1 (50.1)

Caixin services PMI: 52.2 (51.5)

The World of Trump II

Our forecasts for the second term of President Trump concentrate on the economy and geopolitics. At this point we do not forecast the tariffs nor their effects in any more detail. For President Trump, they are first and foremost negotiation tools, and before including them into economic forecasts, we need to see how the trade negotiations go.

Economy

President Trump inherits an economy that is sending rather conflicting signals. We have uncovered many of these in recent Weekly Forecasts (see, this, this, this and this). Indexes of the manufacturing sector also pack a mix message. Most of the sub-indexes, like new orders and business conditions, picked up in Texas, while they declined the Empire (New York Fed), the 10th District (Kansas Fed) and the Fifth District (Richmond Fed) surveys. The only index that rose in all four regions was prices. The direction of the U.S. economy thus remains uncertain.

There are two developments President Trump would need to urgently fix, because they are creating serious long-term problems.

The deficit of the U.S. federal government and thus the interest payments are in an utterly unsustainable trajectory.6 The annual deficit currently runs at around $2 trillion, and at this point it is unclear whether President Trump is willing to take the necessary steps to fix them. Politico reports that he has issued a very expensive plan to the U.S. Congress which includes, e.g., heavy increases in border security, and sweeping tax cuts, but without balancing spending cuts. We are suspecting that he is trusting to both the DOGE (Department of Government Efficiency) and Elon Musk to deliver spending cuts, and to improving economic momentum to provide increased revenue flows. Both of these assumptions may fail.

Economist Mike “Mish” Shedlock created this great chart detailing the spending outlays of the U.S. government.

Mike notes that even if DOGE could somehow cut all of the discretionary non-defense spending totaling one trillion dollars, a recently announced target also for Elon Musk, President Trump wants to increase defense spending heavily. Interest payments may come down (which is not guaranteed), while President has noted that he does not want any cuts to Medicare or Social Security, which are the biggest non-discretionary outlays (excluding interest payments). Moreover, House Republicans have estimated that the price tag for the spending increases and tax cuts could total $10 trillion.

Thus, something simply needs to give in the President’s economic plan during the coming four years. Surprises are also likely to come as the attempted freeze of federal grants and loans, and the offer sent to two million federal workers to resign pre-emptively, with severance pay running through September, before unspecified efforts so shrink the federal government.

Geopolitics

Past week, we warned on the likely failure of President Trump in Ukraine. On Monday, Tuomas commented the leaked peace plan, allegedly by President Trump. If the plan was authentic, it would enforce our view that President Trump still has ways to go before he finds the path to actual (lasting) peace in Ukraine, and that the risk of failure is real.

We consider that the main geopolitical aim of President Trump lies beyond Europe, which indicates that eventually a some form of a peace will be found in Ukraine. We assume that, like during his previous term, he (correctly) views China as the main U.S. rival. Based on comments made by President Trump during his campaign trail, many were assuming that Iran would his main target. We consider this to be unlikely, after Iran demonstrated her capabilities to inflict devastating damage to Israeli and U.S. assets in the region. In October we speculated that Iran may have tested a rudimentary nuclear weapon, i.e., a weapon that produces an explosion, but which cannot be fitted into a warhead, yet. The last thing President Trump wants is a nuclear conflict in the Middle East leading to cataclysmic energy price shock and possible raw-energy shortages. For these reasons, we consider it likely that he opens a line of talks with Iran in an effort to find a peaceful resolution to the conflict in the region. His recent comments indicate that this would be happening.

We consider it very unlikely that President Trump would be seeking a military confrontation with China, which would carry devastating economic and global consequences. His recent comments reflect this. He’s still likely to play ‘hardball’, what comes to economic relations. Yet, there’s likely to be something of a “honeymoon”, during which President Trump takes it easy with China and seeks for a mutual path ahead. The main problem with this is that Beijing is desperately looking for a way out of her gargantuan debt bubble, without starting an economic collapse. This can only be achieved through exporting more. President Trump wants a balanced trade, while Beijing looks to “pillage” the world to save the economy and thus the mandate of the CCP (China’s Communist Party) to rule. These aims are not easily compatible. That’s why we assume that a trade war will eventually erupt between China and the U.S. during Trump’s four year term.

Forecasts for Trump II

The economic policy of President Trump will be first concentrated on helping the economy with tax cuts and shielding U.S. interests with tariffs. However, the deteriorating economic picture in the U.S., and globally, and growing issues in the bond markets will eventually force him to enact drastic spending cuts, which will cause a recession.

Recession would cause the banking crisis to re-surface leading to a wider (global) economic crisis. These can occur in 2025 and 2026, respectively.

President Trump will float the idea of U.S. defaulting on its federal debt at some point, but will eventually walk back from it, when the implications of such a move to the U.S. and global banking sectors is made clear to him.

He seeks and will eventually find peace to Ukraine. What is uncertain, however, how well he is able to stop further escalation in Europe driven by the NATO Deep State and the military-industrial complex (i.e., the Peak Escalation).

At current time, we continue to assume that he fails on the latter and that the European conflict with Russia re-escalates after peace in Ukraine is found.

President Trump does NOT seek a military conflict with Russia.

President Trump will seek a peaceful resolution to the Iran-Israel conflict.

We consider that the main aim of President Trump continues to be China. He is unlikely to seek a military confrontation with China, but his stance will eventually grow more aggressive towards China.

Beijing is desperate to save China’s economy, which implies exporting her problems (over-indebtedness) to the rest of the world. This is unlikely to fit to the plans of President Trump.

We assume that a trade war will eventually ignite between the two leading nations of the world economy. In the worst-case, this appears when the global economy is already in a recession.

We consider that the aim of President Trump concerning Canada and Greenland is a strategic-partnership. That is, he first and foremost seeks access to the vast mineral deposits in both, because the supply of many of the critical rare earth elements are now controlled by China and Russia. See the footnote for an alternative scenario.7

Conclusion: Pros and cons of Trump II

The second term of President Trump has started with some tectonic political shifts, as expected. He has already pushed through strict policies regarding illegal immigrants and border security, floated the idea on annexing Greenland and making Canada the 51st state, dismantled DEI and Woke policies and institutions, halted foreign aid, and fought the shortest-ever tariff-war with Columbia, over returning of illegal immigrants.

We are hopeful what comes to the policies of President Trump. We noted already several times during this first term that he is first and foremost a businessman, which do not start wars (because it’s very bad for the business). This time around we consider that Donald John Trump cares mostly on his legacy. His family, while business-oriented, have grown into the role of a political ‘wall-breaker’ and bringer of true change. These make him (relatively) unyielding of what comes to delivering the change he sees the U.S. and the world needing, with peace being one of them.

The main geopolitical challenge for President Trump arises from his geopolitical model, which looks out-dated. American military might and thus hegemony are dwindling fast, and they cannot be restored to their former glory simply because others, most notably China and Russia, have ‘stepped up to the plate’. Breaking of an empire has rarely occurred without a major war, and this is the main risk his administration may push the world into. While we consider it unlikely that a global conflict would be ignited during his watch, President Trump may unknowingly create preconditions for just that.

Our Peak Escalation hypothesis implies that global conflict is the aim of the NATO Deep State and the military-industrial complex (possibly driven by the group-over-groups, etc.). The re-armament race in conventional warfare, pushed by President Trump, combined with the likely development of the fourth generation nuclear weapons, can lead the world into the verge of a global conflict at the end of his tenure. We naturally hope not to see this, but the possibility of such a Black Swan is something we all need to be prepared for.

Disclaimer:

The information contained herein is current as at the date of this entry. The information presented here is considered reliable, but its accuracy is not guaranteed. Changes may occur in the circumstances after the date of this entry and the information contained in this post may not hold true in the future.

No information contained in this entry should be construed as an investment advice nor advice on the safety of banks. GnS Economics nor any of the authors cannot be held responsible for errors or omissions in the data presented. Readers should always consult their own personal financial or investment before making any investment decision or decision on banks they hold their money in. Readers using this post do so solely at their own risk.

Readers must make an independent assessment of the risks involved and of the legal, tax, business, financial or other consequences of their actions. GnS Economics nor any of the authors cannot be held i) responsible for any decision taken, act or omission; or ii) liable for damages caused by such measures.

Nowcasts are calculated using high-frequency data on the ongoing quarter (or the quarter that has just passed). This “high-frequency” data comes in the form of monthly and weekly indexes on economic activity. For the U.S., we use the Aruoba-Diebold-Scotti Business Conditions Index and nowcasts of the Federal Reserve Bank of Atlanta to form our nowcasts. For the Eurozone, we use the Cyclical coincident indicator of the euro area economy, and for Finland we use the Trend indicator of output and the nowcasts of the Bank of Finland to form our nowcasts.

Purchasing Managers Index, where values above 50 indicate growing output, while values under 50 indicate declining output. All PMI’s were obtained from Trading Economics.

From the Conference Board.

From the Conference Board.

From the ifo Institute.

Forecast have been made with ordinary least squares, which means that it us just a linear trend, drawn from past observations, projected forward. The observations included the quarterly deficit figures from the term of President Biden (Q1 2021 - Q3 2024).

We can essentially envisage two intertwined hypotheses leading into third considering the aspirations of President Trump over Canada and Greenland.

The first one is that President Trump has his eye on the vast mineral resources held by both nations. Greenland, e.g., holds vast deposits of crucial minerals, including the so called rare earth elements, crucial for the digital era. The U.S. military requires several rare earth minerals, but especially metalloid antimony which is needed for, e.g., communication equipment, night vision goggles, explosives, ammunition, nuclear weapons, submarines, warships, optics and laser sighting. China currently produces around 48% of the global supply of antimony, accounting for 63% of U.S. imports of antimony. In December, China announced an export ban on antimony and several other minerals crucial for high-tech products. A vast deposit of antimony was just recently discovered from Greenland.

The second hypothesis is that the spoken aim of President Trump to acquire Canada and Greenland arise from preparation for future cataclysmic events. These may include wars, devastating global pandemics and even major natural events, like the pole-shift. It has been speculated since the first term of President Trump that he’s an advocate of global cooling, not warming. While we consider the hypothesis #1 as the most likely one for President Trump’s interest towards Canada and Greenland, we need to acknowledge the possibility of more sinister (or “crazier”) motives.

These lead to hypothesis #3, which is that some powerful lobbying organization/people in his background are pushing for an actual annexation of Greenland and Canada for one or both of the two reasons outlined above. While we consider this unlikely at this point, it’s an option we have to acknowledge.