Weekly Forecasts 8/2025

Stories told by investments and credit on the U.S. economy, and Peak Escalation update for Europe

Please note that Tuomas will publish his fifth Daily Thoughts of the week tomorrow.

Forecasts:

Are investments signaling a recession or recovery for the U.S. economy?

Update to U.S. credit data, and on the signals it is sending on the direction of the economy.

What is happening with Peak Escalation in Europe (Ukraine)?

What are investments telling about the state of the U.S. economy?

For a period of few weeks, we have been trying to establish a concise picture on the direction of the U.S. economy. This has been mostly in vain. The signals the U.S. economy is sending are highly conflicting or they simply do not show any direction. Now, we turn into (capital) investments for guidance.

Investments are essential to economic growth as they create demand for labor and other factors of production (like miners, entrepreneurs and manufacturers). Investments also dictate the growth of productivity, the sole force behind long-term economic growth.

One of the investment series we have been following is real gross private investment. It gives the inflation-corrected (“real”) sum of money directed to investments in the private sector, i.e., by corporations and households. This is how the time-series of the annualized growth rate of real gross private investment of the U.S. looks like.

So, what does it tell us? The growth rate of private investments is clearly down, but nowhere near recessionary (negative) levels. In other words, it does signal a slowing economic momentum, but not necessarily an impending recession.

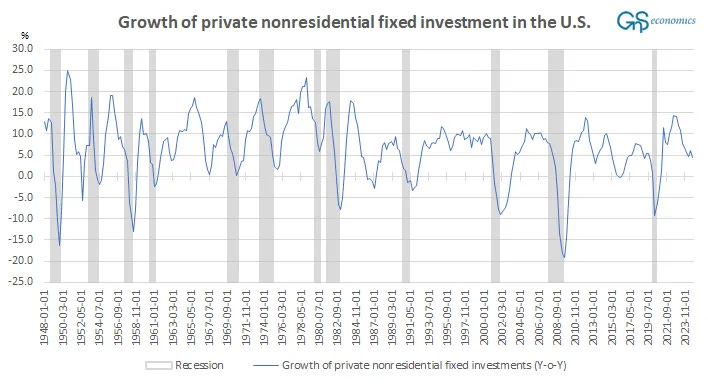

We can broaden this picture by looking at the private nonresidential fixed investments, essentially investments to nonresidential structures (like factories), equipment (machinery) and software, by corporations. This is their quarterly growth rate from late 1948 till today.

The growth rate of private nonresidential fixed investments is heading down in way that could signal that a recession lies ahead. However, in history, there have been several such dives, like in 2015-2016. Thus, the dive can be a false signal also.

So, investment series do not provide clarity on the state and direction of the U.S. economy. How about updated credit data?

The U.S. credit creation: looking for a direction

The developments in the commercial and industrial (C&I) loans issued by U.S. banks led Tuomas to issue call for a credit recession of the U.S. economy in mid-May. We followed by issuing a (preliminary) recession warning for the U.S. We noted that:

What we mean by the U.S. entering a recession is that, while the gross domestic product (GDP) of the U.S. is likely to grow for 1-2 quarters, or more, depending on the level of stimulus which is running extremely high, the momentum of the U.S. economy will keep on declining.

What does the updated data on commercial and industrial loans tell us?

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.