Weekly Forecasts 7/2025

Inflation, DOGE vs. inflation and U.S. consumer sentiment conundrum

Forecasts:

Inflation is returning to the U.S. (like we warned).

Will DOGE crush inflation?

A deeper look on the U.S. consumer confidence.

Inflation comeback

Sometimes is not nice to be right. We have been warning on the re-acceleration of inflation since April. We have also been warning for quite some time that we have not seen the last of this inflation crisis (see, e.g., this piece by Tuomas).

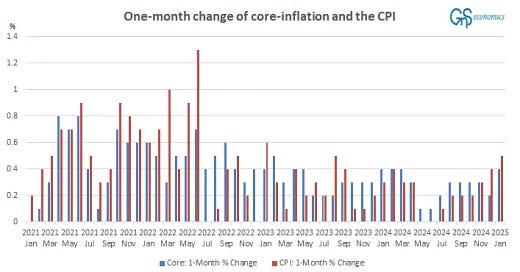

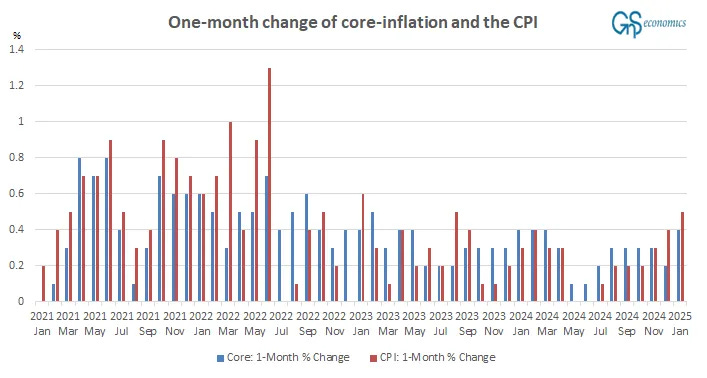

On Wednesday, we got a confirmation on the former. The U.S. Consumer Price Index, CPI, grew by 3% (annualized) in January. The core-inflation, excluding food and energy prices, grew by 3.3% and the ‘super-core’, essentially prices paid on services, less energy services, grew at an annualized rate of 4.3%. The main problem lies in the monthly changes, which look like this.

In a word, they are accelerating. Consensus estimates were: 0.3% for CPI (0.5 actualized) and 0.3% for core (0.4% actualizes). A notable miss.

In early-September, we forecasted that the first rate cut of the cutting cycle of the Federal Reserve would have been 25 basis points. It was 50 basis points. In late-September, we deemed this as a mistake:

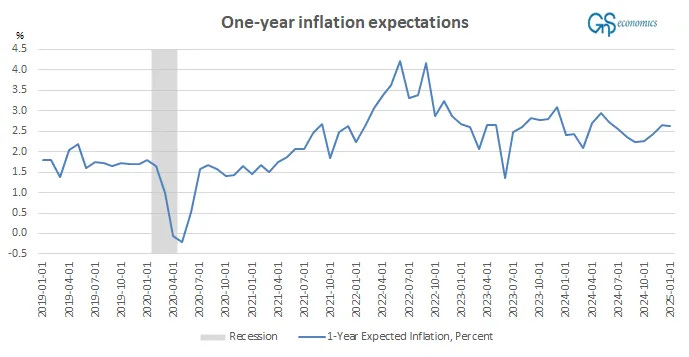

Like we noted in the weekly forecasts two weeks ago, there’s a risk of the U.S. economy heading into a stagflation. With the surprise cut, the Fed increased that likelihood, because inflation expectations have not anchored to the 2% annual rate considered as “stable” inflation, and they may now start to rise again. Geopolitical risks to a stable inflation outlook are also massive. This is why it’s difficult to consider the “emergency cut” by the Fed anything else than a mistake.

This remains (see also Weekly Forecasts 16/2024). For example, one-year inflation expectations hover clearly above the 2% threshold Fed generally considers as a “stable” rate of inflation.

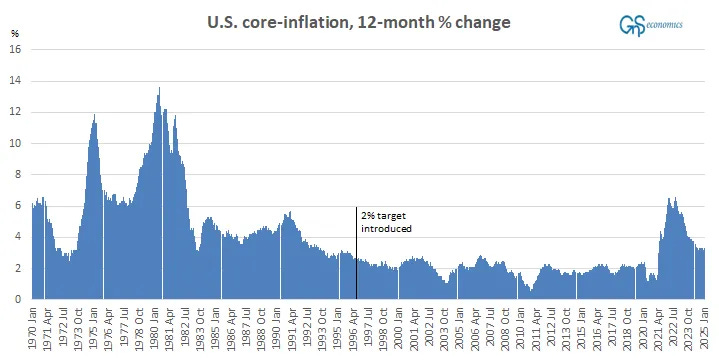

There has been some discussion that the Fed should increase its target inflation rate from 2%. Yet, the 2% target has been shown to provide a stable rate of inflation during the past decades.

If this target would be altered, it could spell the return of a faster, and unstable, inflation regime. While we can debate on the target rate, a considerably consensus of economic research sees rapid and/or highly fluctuating inflation as bad for the economy. This is because it, e.g., increases uncertainty hindering investment-activity.

The problem, like we have been noting, is the massive fiscal stimulus, which is pushing ‘artificial liquidity’ (see below) into the U.S. economy. Another worrying issue is the pick up of M2 money growth, we noted in mid-January. Money growth simply implies that there is more money (demand) looking for products, which has the tendency to hasten inflation (see the Daily Thought by Tuomas). Yet, there’s some hope now that the excessive deficit spending would be reigned in with the help of certain billionaire. Unfortunately, President Trump risks derailing this.

Will DOGE crush inflation?

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.