From Tuomas Malinen’s Forecasting Newsletter.

Issues contributed:

Credit recession is deepening in the U.S.

The private sector has, most likely, already entered a recession.

The likelihood of a second wave of the banking crisis grows rapidly.

In a recent interview Stanley Druckenmiller, a billionaire investor, blasted the administration of President Biden for recklessness and “spending like we would still be in Great Depression”. I wholeheartedly agree.

In 2023, the fiscal deficit of the U.S. government was sobering 6.3%, while during the Great Depression of the 1930s, federal government run a deficit of around the similar magnitude . The only difference was that between 1929 and 1934, over 9800 banks (nearly 40% of the total) failed, industrial output fell by 52%, whole sale prices by 38% and real income by 35%, and at its peak over 24% of the total work force were unemployed. Currently, the U.S. unemployment stands at 3.9%.

Why is the Biden administration running such insane deficits? They are most likely doing it to mask an U.S. recession, which has now started. Let’s take a closer look.

Credit recession

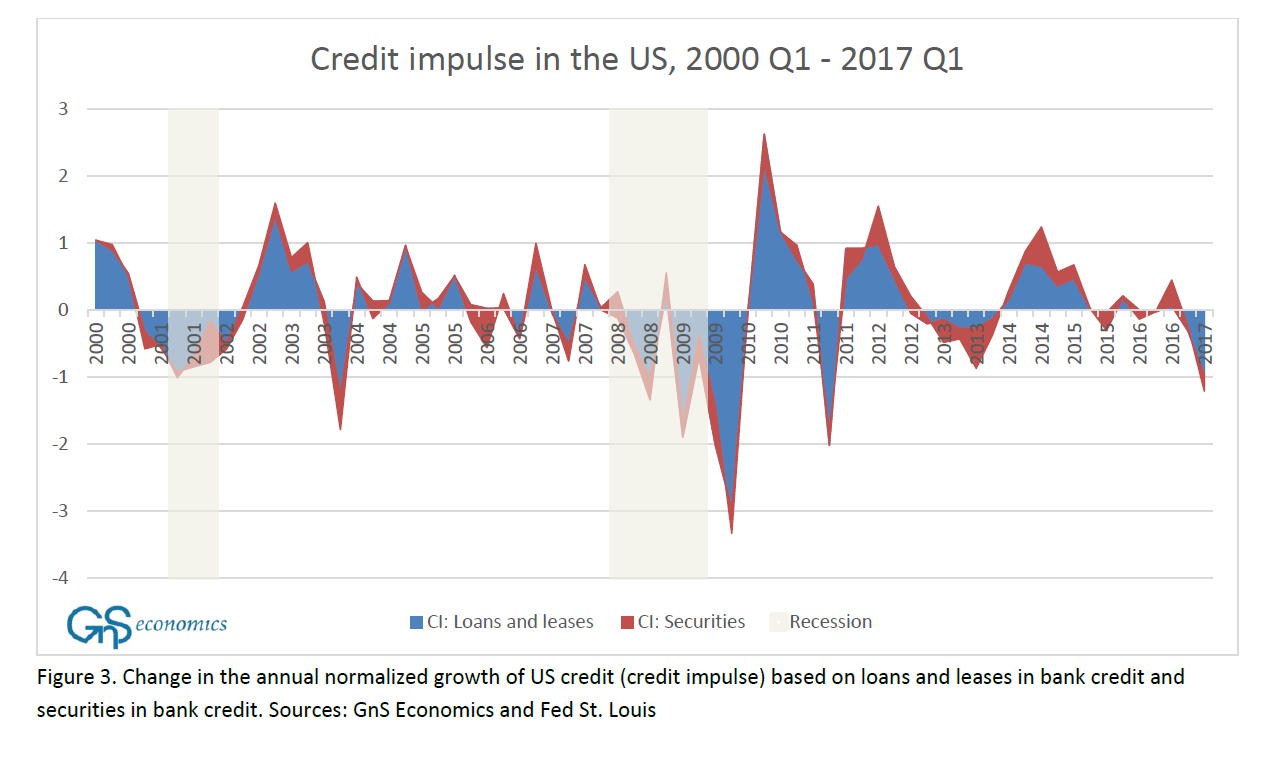

I, and we at GnS Economics, have been tracking the credit creation of U.S. banks for a while. Already in 2017, we used the credit impulses in an effort to assess,1 where the U.S. economy would be heading.

However, we soon discovered that the forecasting ability of these “impulses” was weak. They were just too volatile and thus the forward-looking information they gave was full of statistical noise.2 Thus, we disregarded them.

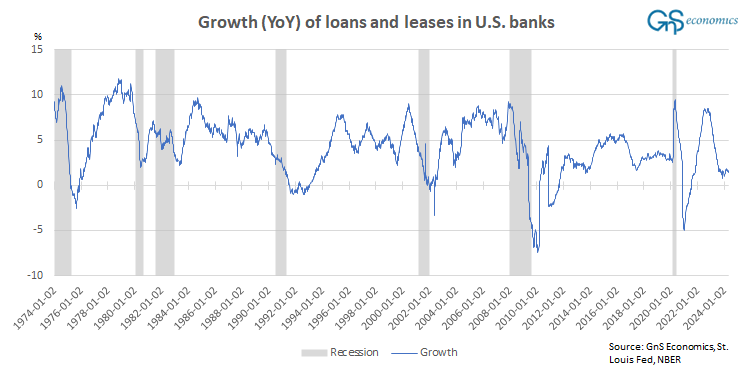

If we observe, for example, the annual growth rate of loans and leases in bank credit (loans and leases given out by commercial banks), it seems much more informative.

What the figure above informs us is that the annual growth rate of loans and leases declines strongly only at the end or after a recession, when consumers and businesses cut back their spending and thus borrowing. What we also observe is that loan growth is currently at levels not seen outside recessions, or right after them. This means that the U.S. is effectively in a credit recession, like I explained in early April, but there’s more.

Private sector recession

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.