Weekly Forecasts 10/2025

Collapsing nowcasts of the U.S. and the China Conundrum

Forecasts:

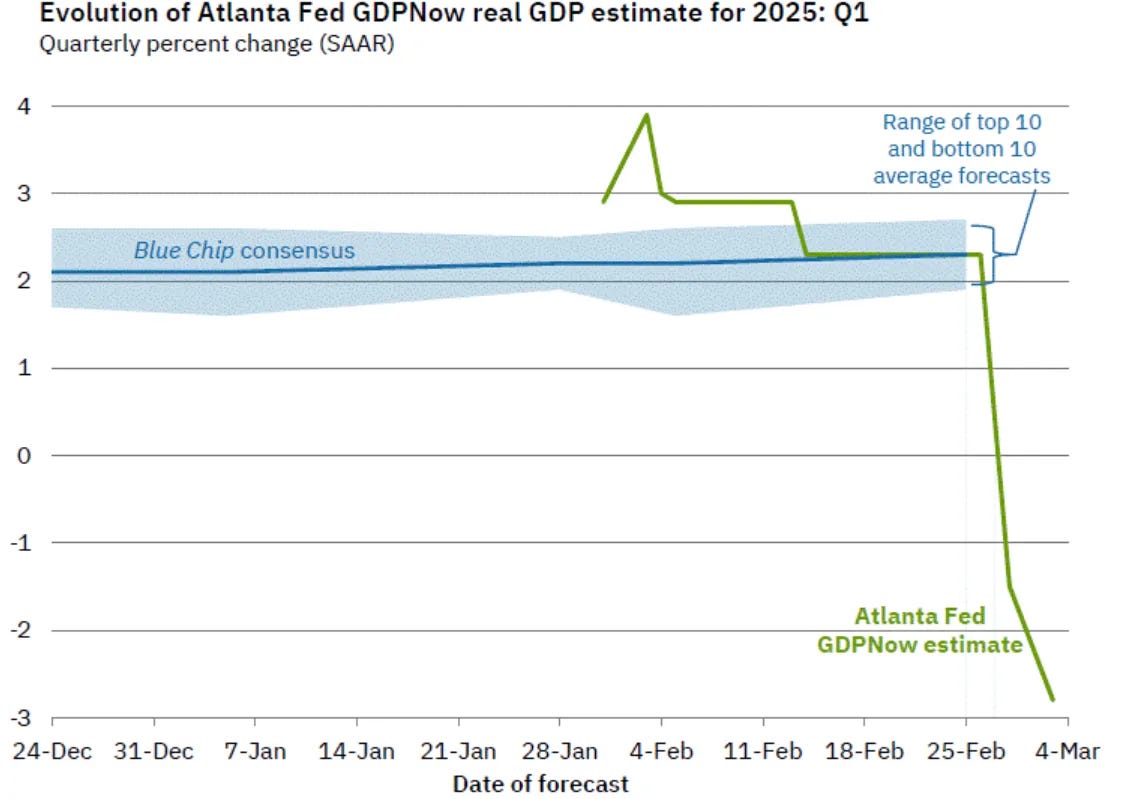

Atlanta Fed GDP nowcast collapses.

China’s declining economic momentum.

For how long can Beijing resuscitate the Chinese economy?

Please note our individual service for the Weekly Forecasts.

U.S. GDP nowcast collapses, quid dat?

The nowcast of the Atlanta Fed for the growth of Q1 gross domestic product have collapsed to -2.8%. What is happening?

This collapse occurred after data updates on 28 February and on 3 March, i.e., right after the publication of our monthly forecasts. Our nowcasts showed that the U.S. economy would grow by 0.5% in Q1 (Q-to-Q), but if we include the updated data of the Atlanta Fed, our nowcast for U.S. Q1 GDP growth falls to -1.5%.

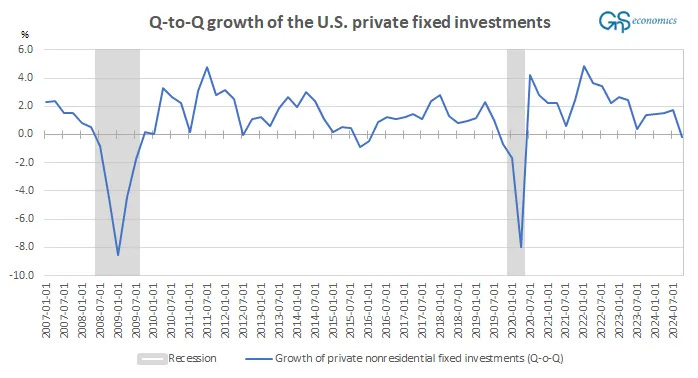

The index was driven down by nowcasts of real private fixed investments, real consumption expenditures and data from the U.S. Census Bureau (employment) and the Institute for Supply Management (ISM). Economist Mike “Mish” Shedlock has provided an excellent analysis on the ISM, which is why we do not delve into it here. We just note the falling private investments, discussed in Weekly Forecasts 8/2025.

In past week’s Weekly Forecasts we noted, based on weak investment data, stagnating credit growth and gloomy mood among U.S. households, that:

Because there’s no quick relief in sight in the form of easing inflation, rate cuts or fiscal stimulus (but the contrary), we can assert that the U.S. has entered a trajectory which is likely to lead into an (overdue) recession. It will not, most likely, start during this quarter, or the next, but Q3 and Q4 are currently looking plausible candidates for the onset of a U.S. recession.

Based on the updated data, and the tariffs that have now come into effect, we will change our conclusion to this: The U.S. recession can even start during the next quarter, while we consider this relative unlikely still, because the another measure behind our nowcast do not show a dive (yet).1 This indicates that the rapid decline of the nowcasts could be a hiccup. We keep monitoring its development.

China’s declining economic momentum

What contributes to the above, and is likely to make the approaching recession global, is China’s continuing economic decline. Like noted by Tuomas on Tuesday, we have been warning on the collapse of China’s economy and its dire consequences for the world economy for some time. Now, we are almost there.

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.