In this issue:

GDP growth forecasts.

Forecasts for the stimulus of China.

Economic indices: the U.S., the Eurozone and China

Choices of the FED.

Update on U.S. banks.

Conclusions

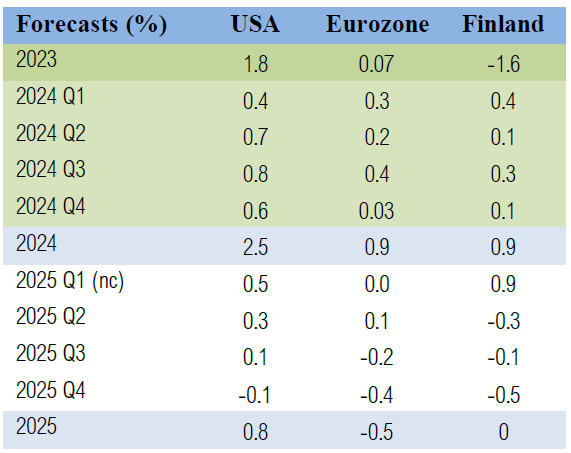

GDP Forecasts

The U.S. gross domestic product (GDP) grew at 0.6% Q-to-Q rate (the first estimate) in the fourth quarter.1 This was a slower pace than we anticipated in our last forecasts (0.8%). Also the GDP of the Eurozone grew at a considerably lower pace than what we forecasted (0.4%), but the Finnish economy grew faster than what we anticipated (-0.2%).

Our nowcasts for Q1 indicate that the momentum of the U.S. economy would keep on slowing, while the Eurozone economy would stagnate. The growth of the Finnish economy would pick up notably during Q1.

Our forecasts for 2025 continue to indicate a slowing economic momentum for all regions. Currently, we forecast that the economies would grow a bit more rapidly in 2025 than predicted by our end-of-the-year consensus scenario. This is mostly due to China providing an uplift for Europe and the world economies for Q2, but by the year-end, all countries/regions would have fallen into a recession, according to our current forecasts.

We are currently assuming that banking problems remain subdued throughout the year. If they do not, growth figures will be clearly below those forecasted above. We’ll take a deeper look at the numbers behind our forecasts in this week’s Weekly Forecasts.

Forecasts for the stimulus of China

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.