Forecasts

(GnS Economics, OECD, Q-to-Q): *The U.S. Q4 figure is an advance estimate.

The combination of exceptionally mild weather in Europe and the lagged effect of the August/September re-leveraging of the Chinese economy carried the European economy in the year-end. However, winds are changing with the Chinese debt-stimulus remaining depressed through December (see below) and colder weather expected to hit Europe in the coming weeks.

The U.S. economy has kept its upward momentum despite of the tightening credit conditions (see the December Outlook) and a manufacturing recession. U.S consumers have tapped on to their credit cards and into remaining stimulus money to keep their consumption up. However, we expect that household consumption will hit ‘the wall’ in Q2 causing the U.S. economy to contract, possible drastically.

Banking issues are brewing under the surface of the European economy. We expect them to re-emerge, when recession truly starts to bite during the second quarter of this year.

China stimulus

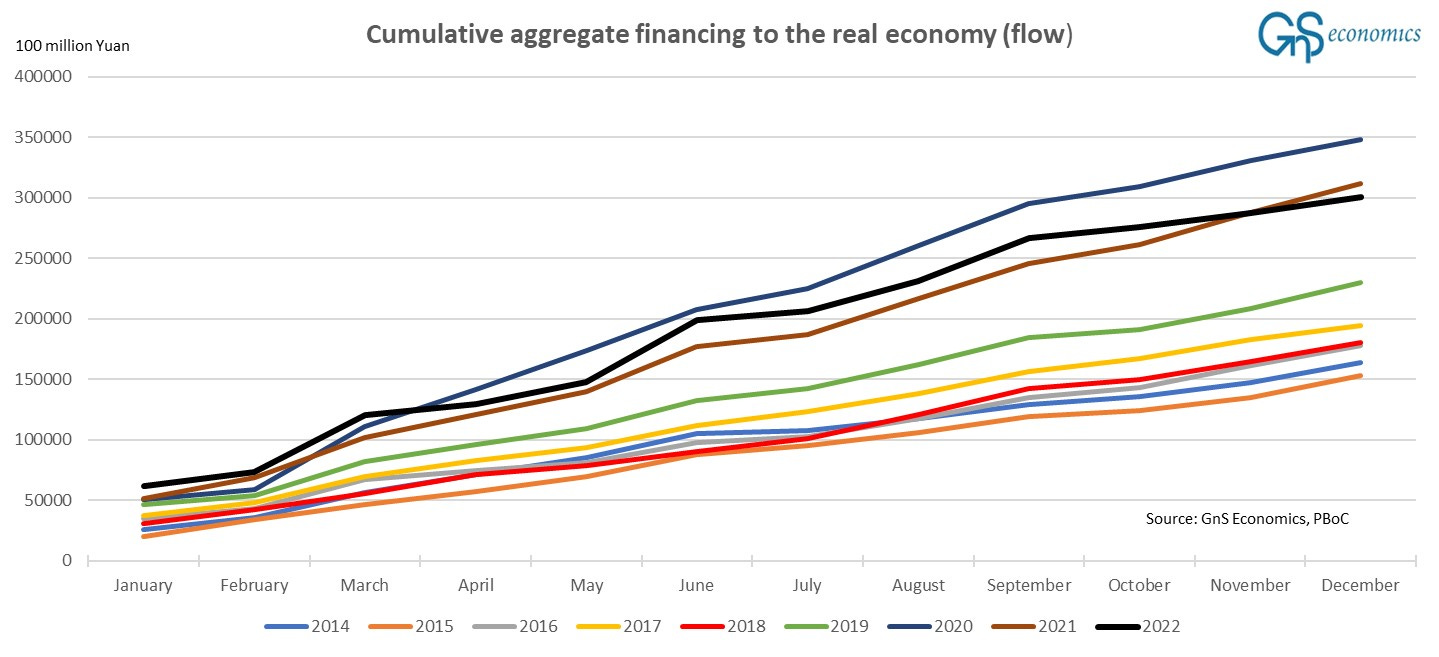

All talk, no action. The aggregate financing to the real economy continued to decelerate in December.

December saw the lowest flow of aggregate financing to the real economy, in December, since 2017 ending the year below the 2021 level. Thus, there’s no visible evidence that Beijing has enacted the stimulus it vowed at the end of 2022, at least yet. Flow of aggregate financing has remained depressed since October, which implies that global economic indicators, especially in Europe, will head back down from February on.

Economic indicators

United States, January (December)

Richmond Fed manufacturing: -11 (1)

Empire State manufacturing: -32.9 (-11.2)

Dallas Fed manufacturing: 0.2 (9.1)

Manufacturing PMI:1 46.8 (46.2)

Service PMI:2 46.6 (44.2)

Consumer Confidence:3 107.1 (109.0)

Eurozone, January (December)

Manufacturing PMI:4 48.8 (47.8)

Service PMI:5 50.7 (49.1)

China, December (November)

Caixin manufacturing PMI:6 49.0 (49.4)

NBS manufacturing PMI:7 47.0 (48.0)

Caixin service PMI:8 48.0 (46.7)

The Outlook

According to the “advance” estimate, the gross domestic product of the U.S. grew at 2.9% annualized rate (around 0.7% Q-to-Q) in the last quarter. This pace was a bit slower than what we forecasted in December (0.8%). The growth in the fourth quarter primarily reflected increases in inventory investment and consumer spending. Residential investment crashed by -26.2%, but federal consumption and investment expenditures grew strongly (6.2%). All-in-all the report was not encouraging. Investments were lackluster and the “carrying force”, i.e., consumer spending is under increasingly heavy strains, as lending standard continue to tighten. According to estimates, households still have around half of the Corona-stimulus money left, which is likely to beef up consumption, but when it runs out, consumer spending is likely to fall of the ‘cliff’.

Also, as we warned in November, manufacturing recession has arrived to the U.S., which is clearly visible on the output numbers above. New orders of manufacturers continued to reside in their post-pandemic lows in the Richmond and New York Fed regions in January. New orders were negative, but not so deeply in the Dallas Fed region. Manufacturers in the New York area saw their general business conditions index fall to lows corresponding those during the depth of the financial crisis and recession of 2007-2009. These and the depressed manufacturing PMI clearly show that the sector is in recession.

Economic situation in the Eurozone has remained relatively stable, yet depressed, helped mostly by the exceptionally mild winter weather across the Continent. This has kept energy prices from spiking, although they remain elevated. European economies have also been propped by the spurt in the debt-stimulus of China in August and September.9 The weather “anomaly” combined with the China stimulus may have even kept European economy growing in Q4 against our forecasts. At the very minimum, they have made the economy of the Eurozone to perform better than we anticipated (forecasted) late past year. It’s naturally nice to err to this direction. However, the decline in China stimulus from October on will start to affect the European economy in February, when we expect the economic indicators to resume their march downwards. If winter finally arrives to Europe, as it now looks, it would accelerate the decline, and cause energy prices to spike, yet again.

Based on the commentary, Beijing now expects economic activity to rebound in the wake of the release of the bend-up demand, which Beijing assumes has been accumulating during the lockdowns. However, considering the high level of indebtedness of Chinese households, this assumption is somewhat questionable.

Beijing has also stated, again, that they will start another round of stimulus measures, but we have to wait and see what manifests. The People’s Bank of China has vowed to keep monetary policy “at least as accommodative”, as previous year. This will probably keep the Chinese economy afloat, but it’s unlikely to provide much support for the world economy.

We are very worried on the escalation of war-rhetoric, especially among the western leaders. Just recently Italy’s Defence Minister has stated that World War III will start at the moment, when Russian tanks arrive to Kyiv and to “borders of Europe”.10 This comes from a long line of harsh comments of European leaders concerning the war in Ukraine. While it’s understandable that emotions are running high due to a war in the outskirts of Europe, escalating the rhetoric is not the way for de-escalating the conflict. We consider it to be rather strange that NATO has made direct threats to Russia over a country (Ukraine) that is not a part of the alliance. Who’s interests does it serve?

We consider that a war between Russia and NATO is the biggest ‘tail-risk’ currently almost completely over-looked by the financial markets. If such an extremely adverse shock would arrive, driven by, e.g., response of Russia on the supply of ballistic missile to Ukraine,11 it would almost surely destabilize the financial system leading to a crash in the markets and to a banking crisis. This could eventually lead to the global financial lockdown on which our CEO Tuomas Malinen wrote about past week. We naturally will keep a close eye on all such developments.

Alas, we are heading into extremely uncertain and dangerous times. We cannot emphasize the importance of preparation enough.

Disclaimer:

The information contained herein is current as at the date of this entry. The information presented here is considered reliable, but its accuracy is not guaranteed. Changes may occur in the circumstances after the date of this entry and the information contained in this post may not hold true in the future.

No information contained in this entry should be construed as investment advice. Readers should always consult their own personal financial or investment advisor before making any investment decision, and readers using this post do so solely at their own risk. Readers must make an independent assessment of the risks involved and of the legal, tax, business, financial or other consequences of their actions. GnS Economics nor Tuomas Malinen cannot be held i) responsible for any decision taken, act or omission; or ii) liable for damages caused by such measures.

Values above 50 indicate growing output, while values under 50 indicate declining output. Figures were obtained from TradingEconomics.

From TradingEconomics.

The Conference Board.

From TradingEconomics.

From TradingEconomics.

From TradingEconomics.

From TradingEconomics.

From TradingEconomics.

Like we have mentioned many times before, Chinese leveraging/de-leveraging shows in the European data with a lag of 2-4 months.

See, e.g., the Tweet by War Monitor.

See, e.g., the Tweet by War Monitor.