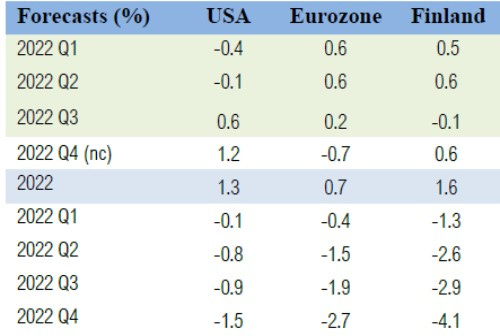

Forecasts

(GnS Economics, OECD, Q-to-Q) Our nowcasts are predicting that the Eurozone will fall into a recession this quarter. GDP growth would remain ok-ish in Finland and have a nice (last) spurt in the U.S. in the current quarter.

Our growth estimates are currently based on the assumption that the first quarter of 2023 will see first clear symptoms of a renewed global banking crisis, which will worsen from there on. This assumption naturally drives our forecasts for 2023. We will return to this in more detail in the December Outlook. However, purchasing manager indexes as well as

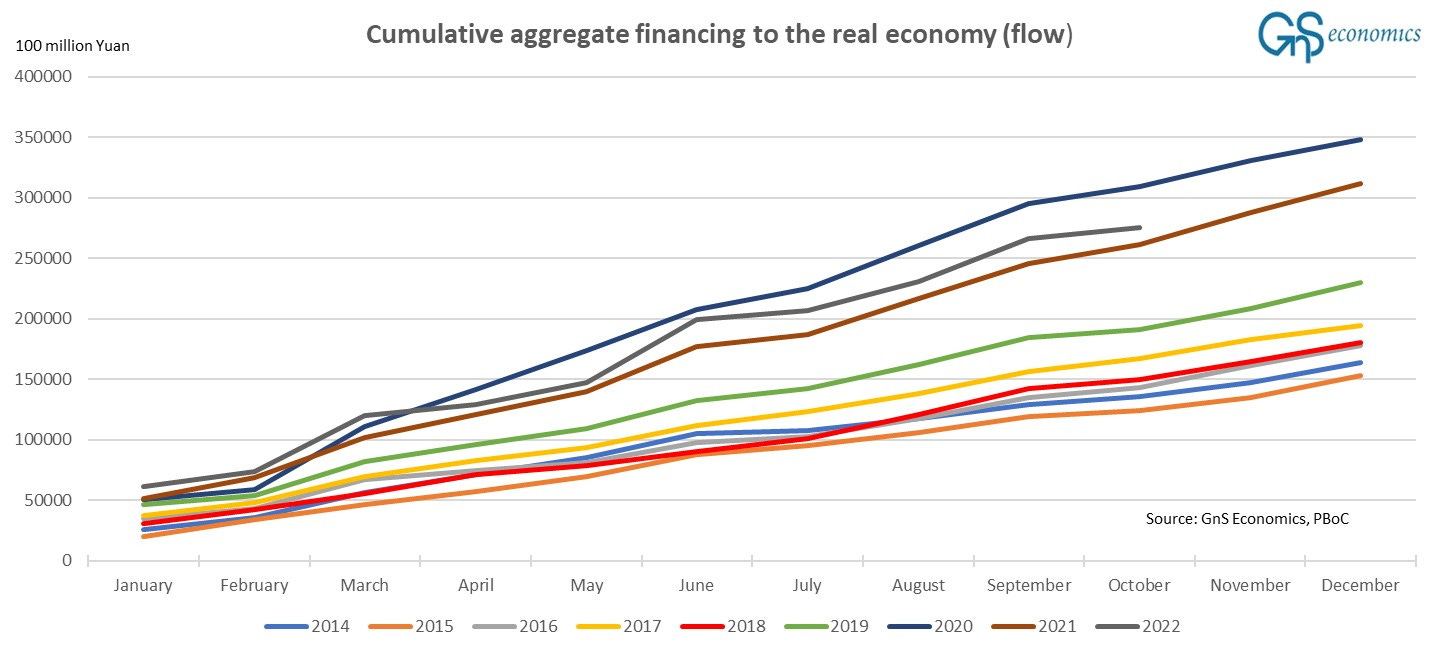

China stimulus

The aggregate financing to the real economy fell off a ‘cliff’, again, in October. October has seen small figures before, but this was the smallest increase since 2019.

“Volatility” has been a characteristic feature of the aggregate financing during this year. It is almost as if Beijing would have lost control of bank lending over which it has held something of a ‘command-and-control’ -grip. At the very minimum, the volatility implies that the Chinese economy may have finally reached ‘debt saturation’, where companies and households are so indebted that they are unable to absorb any larger quantities of debt. In any case, instability in China has increased, in many ways, which is not a good sign for the world economy.

Economic indicators

United States, November (October)

Richmond Fed manufacturing: -9 (-10)

Empire State manufacturing: 4.5 (-9.1)

Dallas Fed manufacturing: 0.8 (6.0)

Manufacturing PMI:1 47.6 (50.4)

Service PMI:2 46.1 (47.8)

Consumer Confidence:3 100.2 (102.2)

Eurozone, November (October)

Manufacturing PMI:4 47.3 (46.6)

Service PMI:5 48.6 (48.2)

China, October (September)

Caixin manufacturing PMI:6 49.2 (48.1)

NBS manufacturing PMI (Nov./Oct.): 48.0 (49.2)

Caixin service PMI:7 48.4 (49.3)

The Outlook

So, based on the PMI:s, all the main ‘engines’ of global economy, China, the Eurozone and the U.S. are entering or have already entered recession. New orders and the business outlook of the U.S. manufacturing firms remained rather heavily depressed indicating a deepening downturn (recession). In Texas, for example, new orders declined to lows not seen since April 2009 (excluding the lows of 2020 caused by the lockdowns). They also reported continuing elevated wage pressures. Manufacturing firms in the district of the Richmond Fed reported that supply-chain issues have persisted keeping inflation pressures elevated in the manufacturing sector.

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.