Weekly Forecasts 18/2025

Economic indices and analysis of China's role in the world economy

Forecasts:

Economic indices for the U.S., Europe and China.

Impulse-response analysis on the effect of China on the world economy.

Forecasts for OECD:s leading indices.

In this week's forecasts, we first update the economic indices. This section was removed from the Monthly Outlook because we wanted the focus on forecasting and on the Black Swan outlook in it. Yet, it became clear that the indices give a constantly updating picture of the current state of the world economy, which also helps us in our forecasting work. Thus, we continue to update them here.

The last two parts of this week’s forecasts we dive rather deep into the world of time series forecasting, again. We are building a set of global time series forecasts on central macroeconomic variables with the aim of establishing a network of forecasts to accurately predict the world economy's performance over the next 12 months. In this report, we mark a significant milestone by presenting a statistical result showing that the Chinese economy is, most likely, driving the global business cycle. We have been speculating on this since 2017, but provide decisive statistical evidence to support this for the first time in this report.

Tuomas

Economic Indicators

United States, April (March)

Richmond Fed manufacturing: -13 (-4)

Empire State manufacturing: -8.1 (-20.0)

Dallas Fed manufacturing: 5.1 (6.0)

Kansas Fed manufacturing: -4 (-2)

Manufacturing PMI: 50.7 (50.2)

Services PMI: 51.4 (54.4)

Consumer Confidence: 86.0 (93.9)

U.S. leading indicator; March (February): 100.7 (101.1)

Eurozone, April (March)

Manufacturing PMI: 48.7 (48.6)

Services PMI: 49.7 (51.0)

Germany ifo Business Climate: 86.9 (86.7)

China, April (March)

Caixin manufacturing PMI: 50.4 (51.2)

NBS manufacturing PMI: 49.0 (50.5)

Caixin services PMI: 51.9 (51.4)

The slump in the U.S. manufacturing sector continues (with the exception of the Texas survey and the PMI), and services also head down. The U.S. recession keeps on edging closer. The positive momentum in European manufacturing sector has continued, which reflects the strong stimulus from China, as we noted in January. China’s manufacturing and service sectors also continue to show strength, which is a result of the strong stimulus-push by Beijing.

Is China leading the world economy? An impulse-response analysis

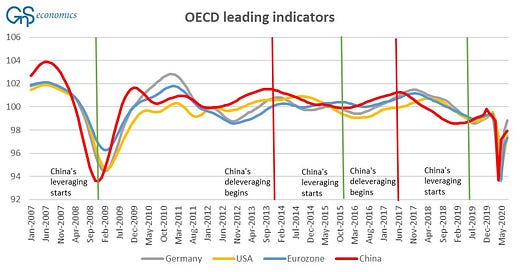

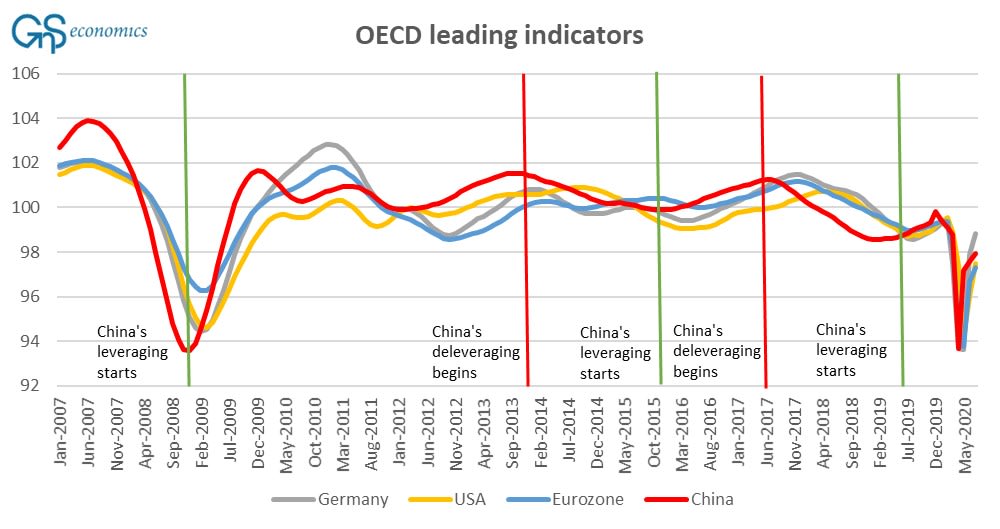

We have been utilizing the leading indices of the OECD to anticipate the turning points in the global economy since 2017. In March 2017, we discovered that China has been, most likely, driving the leading indicators of both the U.S. and Europe. That is, we noticed that the leading indicator of China tends to “lead” the indicators of Europe and the U.S.

Now, we have obtained some statistical evidence of this by analyzing the relationship between the leading indicators using impulse-responses. The impulse-response analysis of time series seeks to uncover the effects different variables have on other variables in the sample. In our case, we look to uncover the effects of changes in the leading indicator of one country (China/Major 4 Europe/the U.S.) on the leading indicators of other countries.1

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.