Everybody is ‘fired up’ on the tariffs today, but I, as always, want to look ahead. Moreover, we warned of this moment already in early February by noting:

This is why we have to warn that, if tariff-wars commence at some point, their effect could be very detrimental in the medium-term. The next few weeks show the direction of travel.

Trariff-war would be unlikely to bode well with the global financial market bubble.

Market reaction to this “Liberation day” was as expected. CNBC actually showed the market “crash” in real time with the announcement of President Trump, and it looks to continue. I think, however, that many analysts are overreacting to the announcement. Tariffs have been used for ages, and now the negotiations for opening the world trade commence, de facto. Still, the short-to-medium-term (months to years) effect can be very detrimental to the global economy if the tariff wars continue and escalate. I am keen to think that they will not, but I cannot say this with high confidence.

What I really want to talk today is this.

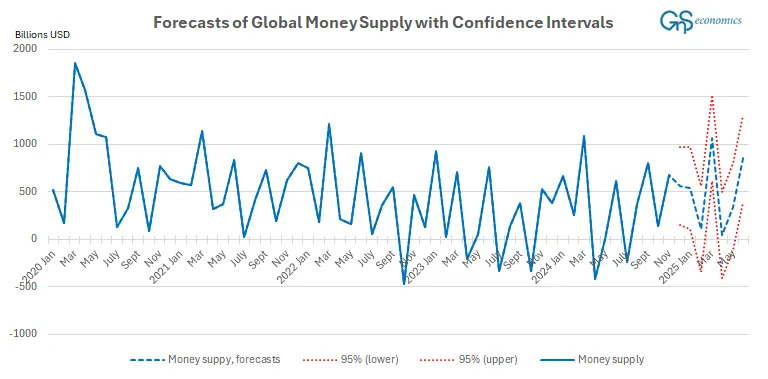

These are global market liquidity (money supply) forecasts from the Weekly Forecasts 11/2025. They implicate that we may have entered a period of liquidity draining associated with market downdrafts. You can find a more detailed explanation, e.g., from here. This is an excerpt (conclusion) from early March.

We are currently assuming that the market downdraft is/has been a much needed correction driven by fear over tariffs and economic growth, with strong global liquidity injections providing support for markets. In this case, we would see markets bottoming out in April or early May (when liquidity injections are set to increase), unless tariff-wars truly flare up, which is naturally also possible.

There’s also another option. The downdraft can be a sign of a major change in the risk sentiment of investors. Recession, re-accelerating inflation and geopolitical uncertainty may have turned investors towards heightened risk-aversion. This would imply that a process of unwinding of large speculative bets and leverage, including record-breaking margin loans in the U.S., has commenced. This would mean that the U.S. would have entered a bear market. In the worst-case, investors could face a combination of dimming economic outlook, up-ticking inflation, heating tariff-wars (and possibly re-heating of other wars) and draining of global liquidity in April. Needless to say that this combination would be devastating to their trust and thus on the markets.

We have now entered the tariff-wars and geopolitical tensions are heating up. Are we up for a market crash (instead of just a correction)?

The answer (forecast) is not easy to give. This is because, for example, in last October, a usual liquidity-draining month in China, the People’s Bank of China injected vast amounts of liquidity of liquidity into the system. In late September, we noted: “While our forecasts continue to indicate a liquidity draining for October, recent actions by the Fed and the PBoC may even turn that into an injection”. While markets dropped, it was just a correction. In mid-November we continued by noting that: “Liquidity-wise, we are thus expecting markets to rally till the year-end, and possibly into January”.

The question is, will the PBoC and/or the Federal Reserve start to provide extra liquidity to the markets? They are likely to ‘step up to the plate’ if markets collapse, but otherwise an answer to the question is impossible to give beforehand.

So, I would be rather cautious in all investing activities this month, regardless of how the ongoing market rout ends. There’s a heightened risk of a market crash. Gold is likely to continue to be an outstanding safe haven.1

Tuomas

Disclaimer:

The information contained herein is current as of the date of this entry. The information presented here is considered reliable, but its accuracy is not guaranteed. Changes may occur in the circumstances after the date of this entry, and the information contained in this post may not hold true in the future.

No information contained in this entry should be construed as investment advice nor advice on the safety of banks. GnS Economics nor Tuomas Malinen cannot be held responsible for errors or omissions in the data presented. Readers should always consult their own personal financial or investment advisor before making any investment decision or decision on banks they hold their money in. Readers using this post do so solely at their own risk.

Readers must make an independent assessment of the risks involved and of the legal, tax, business, financial, or other consequences of their actions. GnS Economics nor Tuomas Malinen cannot be held i) responsible for any decision taken, act or omission; or ii) liable for damages caused by such measures.