This Outlook has five parts, instead of the usual four (Forecasts, China Stimulus, Economic Indicators and the Outlook), because we, exceptionally, publish the list of the most-safe banks of the U.S. in this report. In November, we ran three loan loss scenarios for U.S. banks based on Q3 banking data, entitled: soft-landing, Great Financial Crisis (GFC) 2.0 and the Great Depression 2.0. The banking-sector-wide results were published in the November World Economic Outlook.

Here, we list the banks who survived from the Great Depression 2.0 scenario. Worryingly, only 105 banks survived this extreme stress test. They can be considered as the most-safe banks in the U.S. We, naturally, also map the state of the global recession.

GDP Forecasts

(GnS Economics, OECD, Q-to-Q). The first estimate on the U.S. GDP for Q4 imply that the economy has grown by 0.6% (3.3% annualized) during the last quarter. Our last nowcast from early January was 0.7%. First estimate for the Eurozone indicates that the GDP growth flatlined, which was also our nowcast (from early January). Our current nowcasts indicate that the Finnish economy would have succumbed further in Q4.

Our forecasts for 2024 continue to change with the new information coming in. The announcement of the Federal Reserve, to discontinue the Bank Term Funding Program (BTFP), enforced our view that the banking crisis is likely to re-surface during H1, and in the forecasts, we assume that it re-appears during Q2. However, as noted by Tuomas several times, forecasting the exact time (even a quarter), when banking crisis appears is practically impossible. That’s why the forecasts for 2024 continue to be nothing more than educated guesses.

China stimulus

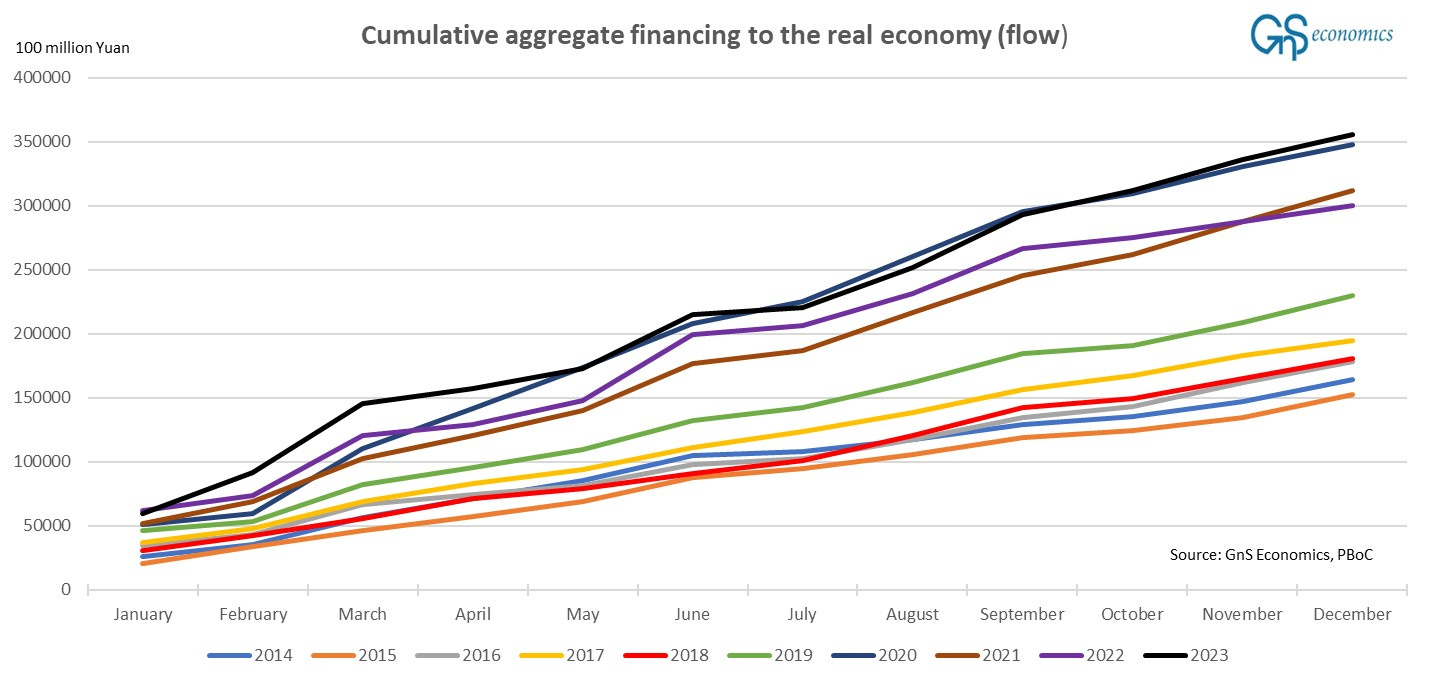

Giving up? The flow of aggregate financing to the real economy grew with a pace of RMB1.94 trillion in December (vs. RMB1.130 trillion in 2022). This was the third-largest increase for December. It may be an indication that Beijing is gradually giving up on the economy, because the stimulus simply is not effective anymore.

The heavy debt-stimulus Beijing ran from September till November has become visible in slightly better-than-expected manufacturing numbers across the globe (see below). However, like we have been warning for several months now, the effectiveness of China stimulus has clearly waned. This means that there’s very little means to stop the world economy entering a recession this year. China is currently enacting new stimulus measures, which we can expect to also be relatively ineffective in actually stimulating the economy.

Economic Indicators

United States, January (December)

Richmond Fed manufacturing: -15 (-11)

Empire State manufacturing: -43.7 (-14.5)

Dallas Fed manufacturing: -15.4 (-7.2)

Kansas Fed manufacturing: -9 (-2)

Manufacturing PMI: 50.3 (47.9)1

Service PMI: 52.9 (50.8)

Consumer Confidence:2 114.8 (108.0)

U.S. leading indicator:3 103.1 (103.9)

Eurozone, January (December)

Manufacturing PMI: 46.6 (44.2)

Services PMI: 48.4 (48.8)

Germany ifo Business Climate:4 85.2 (86.3)

China, December (November)

Caixin manufacturing PMI: 50.8 (50.7)

NBS manufacturing PMI: 49.0 (49.4)

Caixin services PMI: 52.9 (51.5)

World Economic Outlook

While the consumer confidence of the U.S. improved in January, the leading indicator continued its descent (for 21st month). Manufacturing indexes of the New York and Dallas Fed regions sank to levels last seen in May 2020. They did not sink this deep even in the aftermath of the Great Financial Crisis (2007-09). It’s actually a bit surprising that the manufacturing PMI of the (whole) U.S. is in positive territory (above 50), but this increase (from 47.9 in December) was mostly driven by anticipation of notable improvement in new orders in the coming months. Moreover, manufacturing employment declined in all of the four key regions we follow, with heavy declines in the Richmond Fed region. Notably, manufacturing input prices increased relatively rapidly across regions, which imply that inflation pressures are re-emerging (this is what Tuomas recently warned about). That’s why we urge everyone to keep a close eye on Fed presser today. If ‘hawkishness’ in the language of Jerome Powell has grown, Fed has noted the re-emerging inflation pressures, probably resulting to postponing the rate cuts. The situation in the Middle East naturally contributes to this. We go through recent developments there in the Conclusions.

European economy continues to sink, while manufacturing and services PMI’s saw a modest improvement (driven by the China stimulus). Yet, they remained deeply in the contraction territory. The ifo Business Climate Index continued its journey down, with manufacturing firms reporting the only improvement (most likely supported by the China stimulus). Construction activity in Germany is flirting with all-time lows of the survey. The economy of the (former) European powerhouse keeps sinking deeper into the recession.

In China, the troubled property developer Evergrande was ordered to liquidate, by a Hong Kong court, and trading on its shares was halted after they fell more than 20%. Earlier in January, shadow banking conglomerate Zhongzhi Enterprise Group, a financier of property developers, filed for bankruptcy. There’s also a trend emerging, where smaller Chinese banks are merged with larger ones. These are indications of a banking crisis in motion, which authorities desperately try to contain. We thus urge for caution in all activities especially with the smaller regional banks in China.

The most-safe U.S. banks

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.