We apologize for the late-publication of the Outlook (due to illness).

In this last outlook for the year, we concentrate on the prospects of 2024. More precisely, we map out three scenarios for 2024 ranging from an optimistic to a worst-case scenario.

The range of outcomes of the scenarios, and their implications for corporations and investors, has probably never been wider during the time we have been making scenario forecasts (our first scenario forecast was published in December 2012). This underlines the exceptionality of the times and the need to prepare. We will give guidelines for preparation for corporations and investors to each scenario, while presenting our assessment on their likelihoods and forecasts for GDP growth.

In the coming weeks, we will help our customers to prepare by updating the list of most safe U.S. banks. We will, for example, publish a list of U.S. banks, which did not fail in our Great Depression 2.0 scenario.

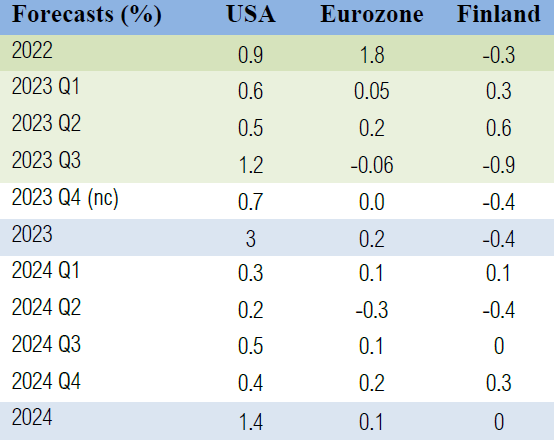

GDP Forecasts (consensus scenario)

(GnS Economics, OECD, Q-to-Q). Our nowcasts indicate that the U.S. economy has continued her robust growth during the last quarter (the forecast is practically unchanged from November). The economy of the Eurozone would not have grown nor diminished, while the Finnish economy would have diminished by 0.4%. In the 2024 consensus forecasts, we assume that banking problems re-emerge in Q2, but that there will be no full-blown banking crisis in 2024 (see below).

Our forecasts continue to suggest the onset of a global recession between Q2 and Q3. However, as we have been touting practically all year, economic forecasts currently include a vast amount of uncertainty. To shed some light into this uncertainty, we present GDP growth forecasts also for the optimistic and worst-case scenarios below.

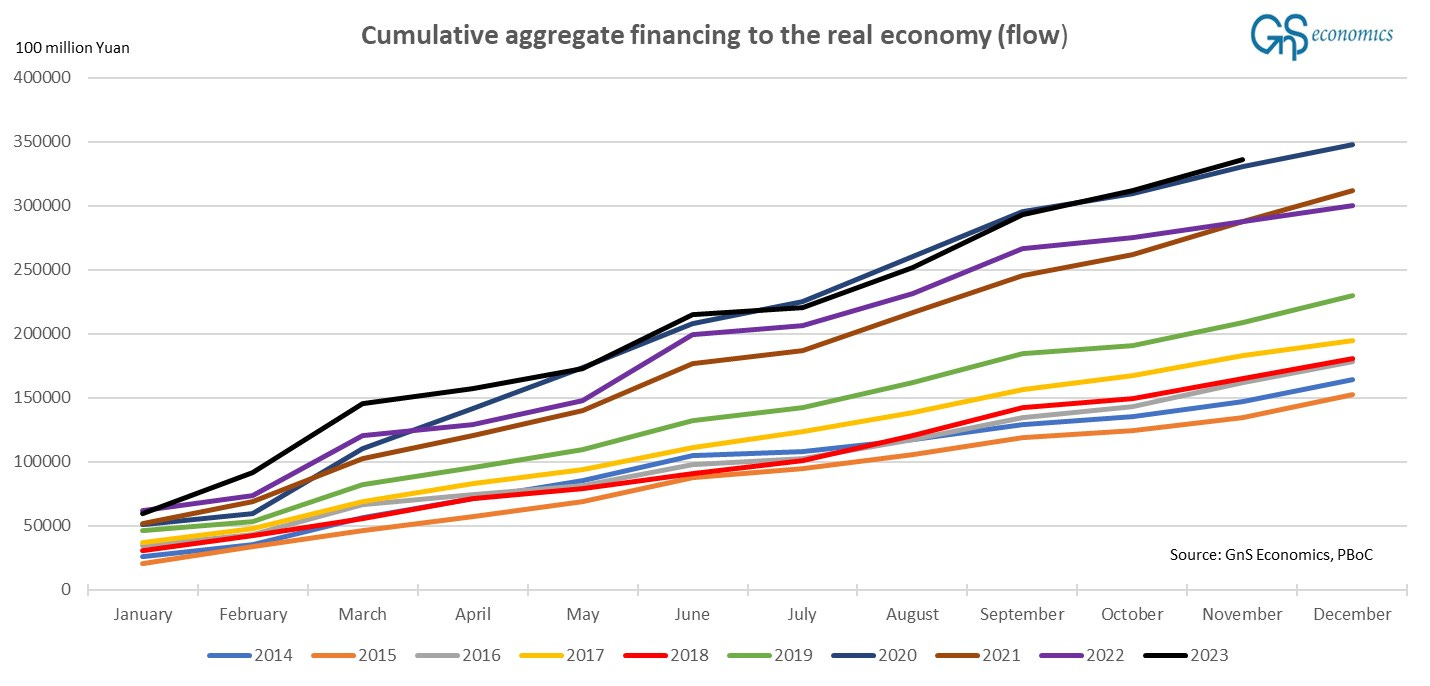

China stimulus

Steady on. The flow of aggregate financing to the real economy increased rapidly in November with a pace of RMB2.45 trillion (vs. RMB1.19 trillion in 2022). This was the second-highest figure for November, surpassed only by November 2021.

Beijing thus keeps on pushing stimulus into the economy at a steady, near-record pace. Beijing has now pushed record or near-record amounts of debt into the economy since August and we are starting to see the effects in (mildly) improving export and manufacturing figures. However, the effect has been much milder than before, which continues to suggest that the effectiveness of China-stimulus has waned noticeably, also globally.

Economic Indicators

United States, December (November)

Richmond Fed manufacturing: -11 (-5)

Empire State manufacturing: -14.5 (9.1)

Dallas Fed manufacturing: -7.2 (5.2)

Kansas Fed manufacturing: -2 (-8)

Manufacturing PMI:1 49.4 (50)

Service PMI: 50.8 (50.6)

Consumer Confidence:2 102.0 (99.1)

U.S. leading indicator; October (September):3 103.9 (104.6)

Eurozone, December (November)

Manufacturing PMI: 44.2 (44.2)

Services PMI: 48.1 (48.7)

Germany ifo Business Climate:4 86.3 (87.2)

China, November (October)

Caixin manufacturing PMI: 50.7 (49.5)

NBS manufacturing PMI; December (November): 49.0 (49.4)

Caixin services PMI: 51.5 (50.4)

The Three Scenarios for 2024

In the scenarios, we concentrate on macroeconomic and geopolitical developments, while the scenarios (unsurprisingly) revolve around wars. This means that there will be several plausible mixing scenarios, where macroeconomic and geopolitical developments can mix between scenarios. For example, we may see escalation in Europe and no nationwide banking crisis in the U.S., or a peace in Europe but a regional war in the Middle East pushing the world economy into stagflation.

The optimistic (peace) scenario

This scenario revolves around the idea that conflicts in Ukraine and in the Middle East come to a peaceful resolution during the first part of 2024. Moreover, this scenario sees a 'soft-landing’ of the U.S. and world economies, while recession in Europe is practically impossible to avoid.

Successful peace-efforst imply that global supply-chain issues, which are worsening again, pass quickly. Europe takes efforts to normalize relations with Russia. While NordStream 2 pipeline remains inoperative for some time still, Russian natural gas starts to flow to Europe again through, e.g., one the intact Nordstream pipelines, Yamal-Europe and Transgas pipelines in full capacity. This considerably eases the pressures felt by companies to move their operations away from Germany and other major Central-European industrial hubs due to energy-related uncertainty. Thus, de-industrialization halts and reverses, somewhat. Europe still experiences a recession, but it ends already during the summer of 2024, because of renewed optimism on the growth prospects of Europe, which leads to gradual increase in investment activity, as well in inflow of foreign investments. However, the continued tightening of EU regulation and the push for ‘Green transition’ hampers the development of certain industries, which hinder the economic recovery.

In the U.S., President Biden keeps fiscal stimulus running throughout the year, and growing optimism among investors keeps the U.S. bond market from imploding. Renewed global optimism and cautious interest rate cuts by the Federal Reserve both re-invigorate the economy and help banks to re-capitalize in the wake of losses tied to commercial real estate and some industrial sections, like trucking. Still, there are few bank failures, but the Federal Deposits Insurance Corporation, FDIC, handles them rigorously. The U.S. flirts with a recession in the second quarter of 2024, with GDP growth slowing close to zero. Growth picks up during the latter part of the year, but remains muted, due to the high level of indebtedness of corporations and households, hindering their consumption.

Scenario likelihood: 20%

GDP forecasts (optimistic scenario)

Implications for corporations and investors:

Corporations would see a gradual return to normal global operating environment. Essentially, there would be no further need for serious macroeconomic or geopolitical hedging.

Markets remain choppy during the first months of the year, but peace talks and Fed interest rate cuts give them a strong boost from around March on, which carries till the year-end with a relatively high volatility, as the global economy flirts with a recession.

The consensus (most likely) scenario

The ongoing conflicts in Ukraine and between Israel and Hamas persist through 2024, with intermittent peace negotiations failing to yield a definitive resolution. As the Russian invasion is taking longer than originally anticipated, the same fate is waiting for the Israel-Hamas conflict. Even Yoav Gallant, the defense minister of Israel has stated that they expect a long and tough war. However, the conflict between Israel and Hamas eases with both the U.S. and Iran scaling back their support to the waring factors. Yet, sustained geopolitical tension continues to disrupt global supply chains, but not to the catastrophic extent seen in the worst-case scenario described below.

In Europe, the economic situation remains challenging. The region grapples with a protracted recession, though not as severe as a depression. Efforts to diversify energy sources reduce the dependency on Russian gas, but the transition is slow. This energy shift results in a mixed impact on industrial operations, with some sectors showing resilience while others struggle. With inflation already high, Europe will most definitely fall into a recession.

In the United States, the Biden Administration faces pressure from the upcoming 2024 elections to stabilize the economy. The Federal Reserve adopts a cautious stance, reducing interest rates in a bid to support the banking sector and the broader economy. However, the effects of this policy are somewhat muted due to persistent inflationary pressures, partly fueled by global conflicts and ongoing supply chain disruptions. The U.S. economy experiences a stagnation, narrowly avoiding a full-blown recession, which also helps it to avoid a full-blown banking crisis.

On the other hand, China, a significant player in the global economy, is expected to face challenges with growth in 2024. Despite accelerated infrastructure spending and a raised fiscal deficit, China's recovery is uneven, partly due to its weak property market and past debt buildup. India continues to grow robustly, increasing her role in the world economy.

Globally, central banks balance between curbing inflation and stimulating economic growth. The Federal Reserve leads this approach with moderate interest rate adjustments, followed by the Bank of England and the European Central Bank.

The banking sector in Europe and the U.S. remain under pressure due to the economic slowdown and loan losses as well as losses from held-to-maturity assets. While there are concerns about the stability of some banks, a full-scale banking crisis will not emerge in 2024, while smaller bank runs similar like in 2023 appear.

Scenario likelihood: 45%

Forecasts

(Presented above)

Implications for corporations and investors:

Corporations would see a some return to normality in their operating environment during the first part of 2024. Hedging strategies would need to be enacted through H1, though, because of the persisting uncertainties concerning supply-chains and the geopolitical situation.

Markets continue exhibit volatility through Q1 2024, but then begin to stabilize helped by the interest rate cuts by the Federal Reserve and easing geopolitical tensions.

The worst-case (war) scenario

Essentially, the first part of this worst-case scenario mimics the scenario presented by Tuomas on the war between Israel and Hamas. The atrocities committed by the Israeli Defense Force, of IDF, in Gaza lead Arab nations to issue oil and natural gas embargoes to all nations supporting Israel. This includes the U.S. and the EU. This will lead to considerable spike in the price of oil and gas, globally. Houthis and Hezbollah become more involved to the conflict, with Hezbollah opening a northern front with Israel. Israel retaliates by bombing not just Lebanon but Iran. Iran retaliates forcing the U.S. to intervene with strikes to Iran. Iran, Egypt and Syria declare war to Israel. Iran closes the Strait of Hormuz from all traffic heading to the U.S. or Europe, causing the prices of oil and LNG (liquified natural gas) to skyrocket. Europe faces a serious deficit of natural gas forcing many countries to enact gas-rationing. This turns the European recession into a depression.

The sudden spike in energy prices reinvigorates inflation pressures forcing central banks to enact another round of interest rate rises, most notably in the U.S. The massive uncertainty combined with renewed ‘hawkishness’ of central banks crashes the financial markets. Finding themselves between the rock and hard place, central banks start another round of asset purchases (QE) to avert the collapse of financial markets. At the same time, another wave of banking crisis engulfs the U.S. and Europe.

Moreover, the stubbornness of Ukrainian (and the U.S.) leaders of not pursuing for peace, combined with collapsing support of western nations for the war, leads to a collapse of the Ukrainian army in the spring. Russia proceeds rapidly to Dnepr after which Ukrainian military high command surrenders unconditionally. This creates wide-spread fear across Europe, crippling investment activity and causing outflow of foreign investments. The EU responds by proposing an “European Defense Fund”, a €4000 billion plan to shore up European defenses and (essentially) to create a common European defense structure. Russia responds by considerably increasing her military spending, leading to, yet another, rearmament of European continent.

Tensions in the South China also intensify towards the year-end, like does the situation in the Korean Peninsula. The world marches towards a World War Three.

Scenario likelihood: 35%

Forecasts

Implications for corporations and investors:

Corporations need to prepare for worsening and even existential supply chain disruptions especially concerning energy products. Disruptions in international freight are likely to be massive. Insourcing is highly recommendable.

Markets enter into a volatile 2024, and they are likely to crash at some point. Resumed money printing by central banks is likely to provide support for markets especially during H2.

Conclusions

The U.S. economy grew by $547 billion dollars, or 4.9% in Q3. This is a very decent figure, but it’s rather heavily over-shadowed by the fact the Federal budget deficit grew by $621.5 billion at the same time. The administration of President Biden is pushing this vast deficit for one simple reason: to stop the economy from succumbing before the Presidential elections in November.

With wars in Ukraine and the Middle East, the policy options of President Biden are likely to differ. This is because a regional war in the Middle East would deliver a devastating blow to the U.S. economy through skyrocketing energy prices, which would also inflame inflation pressures. There’s no such risk related to Ukrainian war. This means that it the Biden administration may even escalate the war in Europe to gain popularity. This could benefit them, if a wider-war in Europe could be marketed to the U.S. populace as necessary and/or fight against “evil”. However, considering growing criticism against the war in the U.S. media and among social media influencers, escalation could also turn against the sitting President.

Yet, the fact remains that, if President Biden heads into the November election with yet another lost American proxy war and the economy in a recession, his chances of winning will be very low. Another major uncertainty relates to the conflict in the Middle East, as it’s possible that the path of escalation cannot be stopped anymore (while we don’t think the region is there yet, it’s getting close). This is why we consider the chances of deepening escalation, globally, to be high, which is reflected in the high likelihood of the worst-case scenario.

All in all, chances are high that 2024 will turn into a year of chaos, instead of hope. There simply are too many detrimental economic and geopolitical developments ‘converging’ towards something that can only be described as “chaos” (which again is reflected in the high likelihood of the worst-case scenario). We naturally hope this will not come to pass, but it’s something we need to prepare for.

Regardless, we wish everyone a very successful 2024!

Disclaimer:

The information contained herein is current as at the date of this entry. The information presented here is considered reliable, but its accuracy is not guaranteed. Changes may occur in the circumstances after the date of this entry and the information contained in this post may not hold true in the future.

No information contained in this entry should be construed as an investment advice. GnS Economics nor any of the authors cannot be held responsible for errors or omissions in the data presented. Readers should always consult their own personal financial or investment advisor before making any investment decision, and readers using this post do so solely at their own risk.

Readers must make an independent assessment of the risks involved and of the legal, tax, business, financial or other consequences of their actions. GnS Economics nor any of the authors cannot be held i) responsible for any decision taken, act or omission; or ii) liable for damages caused by such measures.

Purchasing Managers Index, where values above 50 indicate growing output, while values under 50 indicate declining output. All PMI’s were obtained from Trading Economics.

From the Conference Board.

From the Conference Board.

From the ifo Institute.