A rather troubling theory has emerged about the decision-making process behind the strikes against Iran. This theory suggests that the strikes were based on an AI recommendation, prompting us to question our current level of immersion in AI-dominated decision-making. In this Black Swan Outlook, we concentrate on the possibility that the ‘Terminator scenario’ is not far off.

In this outlook, we also continue to analyze the leading indicators of the OECD. Their are turning out to be a ‘tough nut to crack.’ In this report we present some new results while introducing you to the two key concepts in time series analysis, namely: autocorrelation and heteroscedasticity. As usual, we will also provide GDP growth forecasts and an update on China's stimulus.

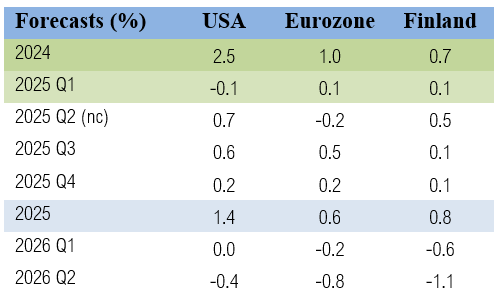

GDP Forecasts

Nowcasts have changed quite a lot from past month. First, we forecast that the growth of the U.S. economy will be considerably higher during this quarter (2.8% annualized vs. 2% past month). On the other hand, our nowcast indicates that the GDP of the Eurozone would have shrunk in this quarter, while Finnish GDP would deliver a healthy 2% growth (annualized).

For the first time, our U.S. forecasts are based on a model utilizing data and forecasts on (real) private gross investments. We analyzed them for the first time in mid-June. Our forecasts indicated a notable acceleration of the U.S. economy before falling into a recession during Q2 and Q3 next year. Based on the improving economic indicators, and nowcasts, the first part of our forecast (acceleration) seems to be occurring.

Similarly we are seeing a pickup in economic activity in Europe following our forecasts based on the leading indicators of the OECD. We have been actually “warning” on the likely (short-lived) acceleration of the global economy since mid-January. We will fine-tune our forecasts on the onset of a global recession in the fall.

The stimulus of China

Rush. The amount of money entering the Chinese economy grew by RMB2.287 trillion in May. This was the second highest flow of financing in May, since 2020. Our forecast was RMB3.273 trillion, a notable miss to the upside. This emphasizes that our forecasting model is not performing in a satisfactory manner currently. For this reason, we refrain from forecasting the aggregate financing of the real economy of China until we find a model suitable for forecasting them.

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.