Weekly Forecasts 16/2025

What about that inflation and bank lending (in the U.S.)?

Forecasts

Into the inflation shock #2?

Developments in U.S. bank lending.

Forecasts of U.S. bank lending.

Is inflation shock #2 on its way?

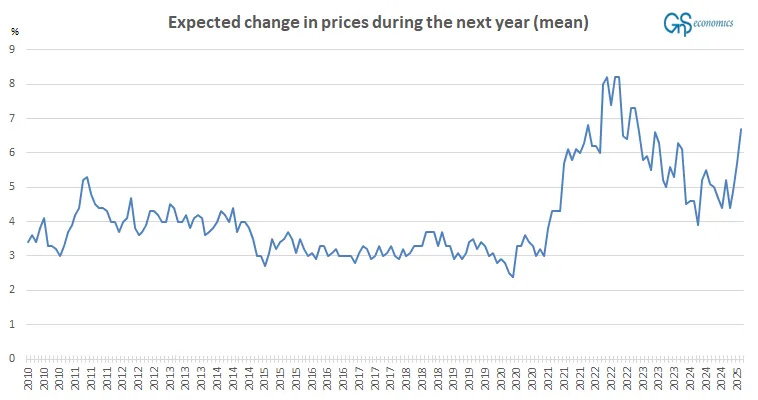

Last week’s inflation figures were better than expected, but there is quite a worrying development lurking in the background. The U.S. Consumer Price Index (CPI) rose by 2.4% annualized in March, but the month-to-month change was negative 0.1%. This was the first MoM negative print since May 2020. The core-inflation, excluding food and energy prices, grew by 2.8%, and the ‘super-core’ (prices paid on services, less energy services) grew at an annualized rate of 3.7%. This is all very promising, but the inflation expectations of the University of Michigan have skyrocketed.

Year-ahead inflation expectations of U.S. households have been shooting up since December. According to Surveys of Consumers Director Joanne Hsu:

Year-ahead inflation expectations surged from 5.0% last month to 6.7% this month, the highest reading since 1981 and marking four consecutive months of unusually large increases of 0.5 percentage points or more. This month’s rise was seen across all three political affiliations.

It is noticeable that this uptick started right after Donald J. Trump was elected to serve his second term as President of the U.S., but before his tariffs were announced. Furthermore, there was no comparable increase in inflation expectations during his first term, which also involved tariffs, albeit to a lesser extent. This makes us wonder: is there something else going on? It needs to be noted that the one-year and five-year inflation expectations calculated using data on Treasuries (inflation swaps, inflation data, and surveys) have not budged in either direction.

We are now approaching the point with inflation and monetary policy we have been warning about for some time (see, e.g., the March 2023 piece by Tuomas). What would come of inflation now if the Federal Reserve needed to restart its QE program, for example, to stop a rout in the U.S. Treasury markets?

The CPI data in this month and in May will show the impact of tariffs. The effect can be more tamed than many think, because in the short-term companies usually try to bury price increases into their contribution margins. In June, if the 90-day "truce" holds, only a few trade settlements will be agreed upon, and if President Trump continues to maintain his threat, reciprocal tariffs will come into effect. Even without the possible escalation in the Middle East, the inflation picture can turn very murky going into the summer.

Tuomas will publish his first inflation forecasts tomorrow. They will, naturally, be made available also here.

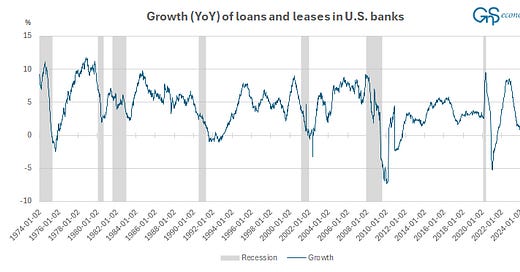

Recent developments in U.S. bank lending

We have been following two U.S. bank lending series for our short/medium-term outlook of the U.S. economy. We (Tuomas) first noted the stagnation of the issuance of commercial and industrial loans by U.S. banks in late-May 2023. In November 2023, we incorporated the loans and leases series into our analysis. In mid-May 2024, the stagnation of loans and leases and the decline of commercial and industrial (C&I) loans led Tuomas to call a private sector recession for the U.S.

Now, we extend our analysis by providing the time series forecasts for the loans and leases and C&I loans by U.S. banks. We do this to uncover the hidden information within the bank lending time series. That is, we aim to harness the information that the CPI series holds on its future development, which is practically inaccessible without statistical forecasting models. To be more precise, long-time series hold information on the future development of the series, in a mathematical/statistical sense, which is very difficult to come by by simply observing the series. Time-series forecasting models have been built to uncover and exploit this information to provide estimates (forecasts) on the future development of the series.

Before getting into the forecasting, we briefly analyze the recent developments of the series. This is the current annualized growth rate of loans and leases reported (weekly) by U.S. banks.

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.