From Tuomas Malinen’s Forecasting Newsletter.

Issues discussed:1

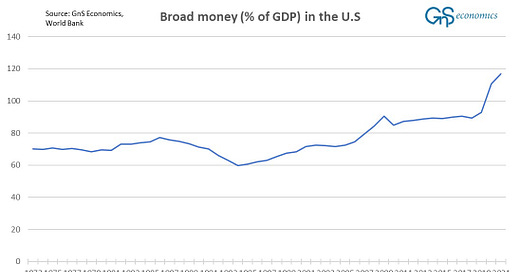

The reckless money printing of the Federal Reserve has made the U.S. economy vulnerable to a wide variety of “monetary” shocks.

The Fed cannot solve the ‘unholy trinity’, i.e., inflation, financial crisis and (approaching) recession, at the same time.

A major credit event approaches.

I am going to take you through a chart-show. I’ve been pondering the role of money, more precisely M2 and deposits, in the U.S. economy since January and have grown rather worried on the implications of the reckless money printing, enacted by the Federal Reserve between March 2020 and April 2022, in the process. The reckless QE-programs of the Fed, stimulus checks of the federal government and lockdowns, which suppressed consumption opportunities, created a rapid inflation, which forced the Fed to enact a record-breaking interest rate hiking cycle.

As a consequence, the Fed is now facing a ‘unholy trinity’, which it simply cannot solve without causing either another inflation shock or a collapse in the financial system. The current trajectory is pushing the U.S. towards a credit event of epic proportions.

When all you have is a (money) printer…

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.