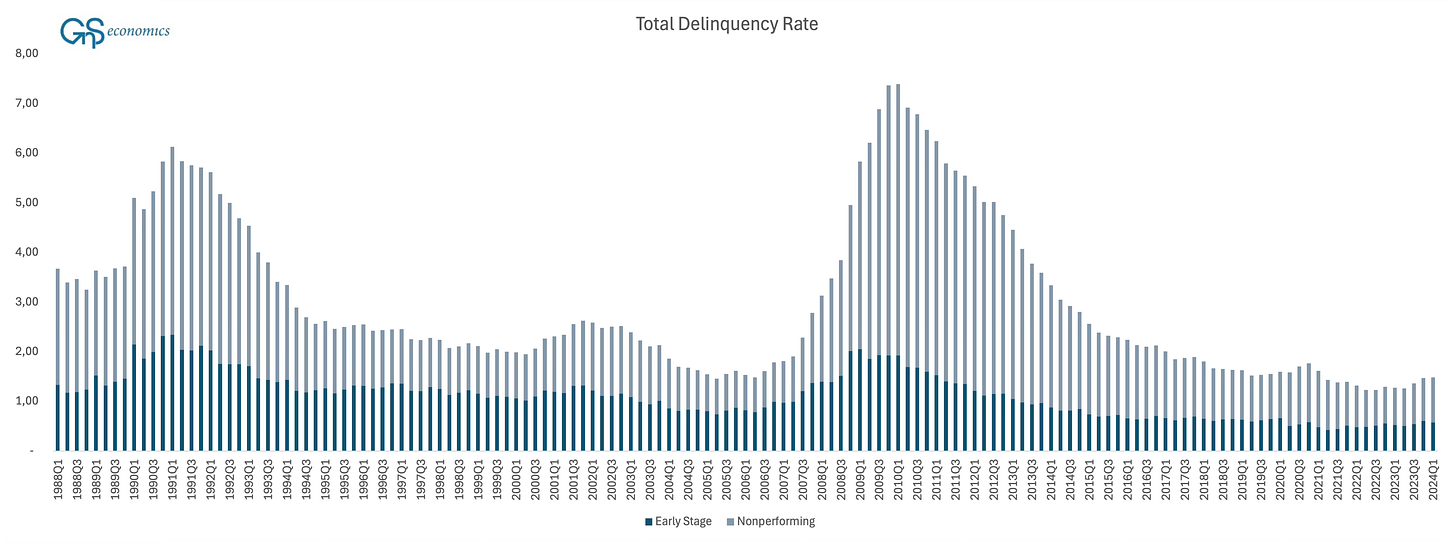

Total Delinquency Rate has been rising for the last 4 quarters. Total Delinquency include Early Stage Delinquencies which includes loans Past 30 days to 89 days but still accruing interest and Non Performing Loans(NPLs), which contains the Past 90 Day but still accruing and the Nonaccrual loan types1 . Delinquency rate has been rising constantly for the past 6 quarters now, adding 25 basis point during this period. While this may not seem like a lot, this surge represent 22 billions of dollars added to the Delinquent Loans in the whole U.S. banking industry.

As Early Stage Delinquencies go to the NPL bucket as it hits 90 days, we mainly focus on the NPL data from now on. They provide important information on which point in the business cycle we currently reside. Our analysis indicates the onset of U.S. recession to be close.

Cycle Comparison

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.