The world economy is about to hit a ‘wall’. China’s growth model is effectively at the end of the road, the onset of European recession is not far and the U.S. is heading into a ‘credit-recession’. This combination is likely to be utterly devastating for the world economy.

In this issue of our Deprcon World Economic Outlook series, we keep mapping the road of the world economy into the ‘deep’.

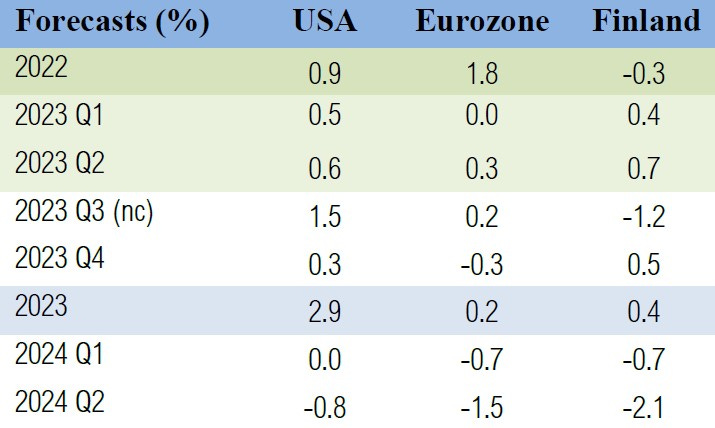

GDP Forecasts

(GnS Economics, OECD, Bank of Finland, Q-to-Q). Updated data from the OECD shows that the Eurozone narrowly averted a recession during H1. Our recession call for the Eurozone from November was thus erroneous, after all (while only marginally). It’s a beauty of economic forecasting that it takes quite a while to know, whether you got it right. Europe was saved by the exceptionally mild winter, which we naturally were unable to anticipate, but this is the reality we ended up into. In addition, growth of the U.S. and Finnish economies have been strong in H1.

Our nowcasts show a strong bounce for the U.S. economy for this quarter, but it’s likely to be short-lived, as explained below. They also indicate that European economy would continue to hum along, but that Finnish economy would be having a rather rough quarter.

For Q4, as explained in detail below, we are assuming the return of financial market turmoil, which would start a process leading to another, more serious waves of the banking crisis hitting the world economy during Q1 and Q2 2024. As we have been detailing, the banking crisis is far from over, but the timing of its re-appearance is currently a guessing-game, because it’s the very nature of a banking crisis to be somewhat unpredictable. This means that bank runs can re-surface already during Q4.

Thus, all forecasts from next quarter on should be taken as just educated guesses of what the growth rate could be. Uncertainty continues to be very high.

China stimulus

Given up? The flow of aggregate financing to the real economy declined notably to just RMB528.2 billion in July, which was some RMB200 billion less than in 2022. The cumulative flow is now under last year’s level.

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.