From Tuomas Malinen on Geopolitics and the Economy.

It has been an intriguing few days. They culminated, for now, in the “pause” announcement by President Trump yesterday concerning the reciprocal tariffs. The market responded with a ‘face-ripping’ rally, as expected.

I am rather certain that the pause was on the mind of President Trump when he announced the tariffs, but surely the looming collapse of the credit markets played a role in the timing. Last Thursday I noted:

I think, however, that many analysts are overreacting to the announcement. Tariffs have been used for ages, and now the negotiations for opening the world trade commence, de facto. Still, the short-to-medium-term (months to years) effect can be very detrimental to the global economy if the tariff wars continue and escalate. I am keen to think that they will not, but I cannot say this with high confidence.

And so, we are here, after some rather brutal market reactions. Very little actually changed, though. Recession is still incoming, 10% tariffs stay in place (125% for China), the U.S. federal budget deficit keeps on growing, and geopolitical tensions are on the rise. Since February, we at GnS Economics have been warning of a draining of market liquidity in April, and we anticipate market-support measures from Chinese leaders soon. Still, without any major (positive) central bank announcements, I don’t think we have seen even the short-term (monthly) bottom in the indexes yet.

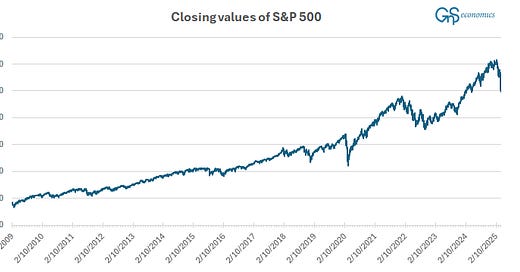

What is missing in the playbook of many investors is that we are at the last ‘gasps’ of a major bull market, which has run since 2009 with essentially just two interruptions: the Corona panic in March 2020 and the Russo-Ukraine war/inflation slump in 2022-2023.

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.