China’s economic cycle has turned downwards some months ago, which indicates deepening troubles for European and world economies. Banking issues are raising their heads in different parts of the globe hinting at the possibility of banking crisis re-surfacing in the fall/winter.

Unforeseen political chaos has gripped the United States. The failed assassination attempt on former President Donald Trump and President Joe Biden effectively resigning through a post on the social media platform X (formerly Twitter) are unprecedented. It’s likely that the chaos will ensue till the Presidential elections on 5 November.

GDP Scenario Forecasts

(GnS Economics, OECD, Atlanta Fed, Statistics Finland, Trading Economics, Q-to-Q). The first estimate for the growth of the U.S. annualized gross domestic product (GDP) came at 2.8%, or 0.7% Quarter-to-Quarter. Our forecast from the end of June was 0.6%, so we missed only marginally. Our last nowcasts for Q2 have changed only for Finland. The current nowcast indicates that her GDP would have grown by 0.2% in Q2, instead of 0.1% nowcasted in June.

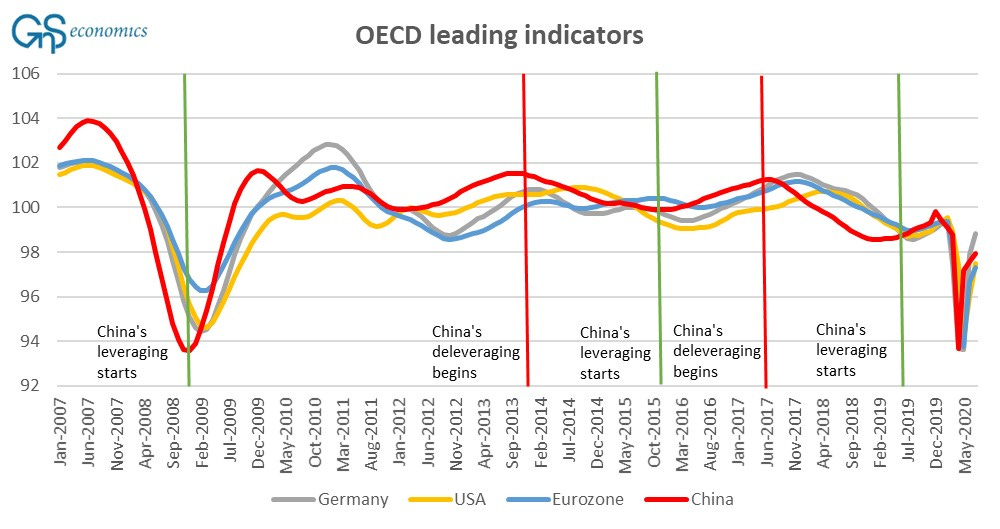

The gargantuan domestic fiscal stimulus is carrying the U.S. economy and China’s “stimmu” has pushed Europe to stronger growth. However, like we note below, Chinese stimulus is waning, which implies that European economic indicators are likely to take another (deeper) turn south during the fall. Possible rate cuts by the European Central Bank (ECB) can provide some support, but their effects will be short-lived. This is because China dominates (leads) the European business cycle visible, e.g., in the pre-Covid leading indicators of the OECD.

The message of the figure is clear, China leads the European business cycle by around 3-4 months and that of the U.S. by 4-6 months. However, it seems that this lag has grown, post-Corona (see below).

China stimulus

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.