The Federal Reserve is losing control of the bond market or, alternatively, there’s a sinister plan in play to cover the federal U.S. deficit, while pushing rest of the world into a recession.

Credit recession continues in the U.S.

Chaos looms in the Middle East, which would have serious repercussions for the global energy markets.

Our forecasts are mostly aimed at presenting the hidden risk, “Black Swans”, threatening your assets, business and/or personal security. As forecasting Black Swan events is highly speculative, the outcome of our forecasts cannot be guaranteed. Thus, while our forecasting record of major events is close to impeccable, our forecasts are, first-and-foremost, meant as warnings for possible future events. See our full disclaimer at the end of the piece.

The Fed is losing control, or…

The U.S. Treasury yields have been heading higher since the “emergency” 50bps cut by the Federal Reserve in mid-September. This is the exact development the FOMC (Federal Open Market Committee) did not want to see.

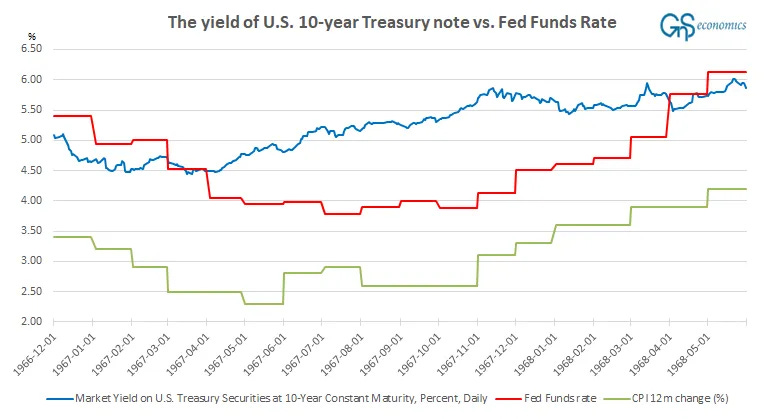

One period in history, which can hold the information of what’s coming next, is the failed rate cut cycle between 1966 and 1968. The Federal Reserve started to cut rates in December 1966 in anticipation of cooling inflation. Rates reached their bottom in July 1967, while inflation bottomed a month year earlier, and started to creep up. The bond markets had noticed the erroneousness of the rate cutting cycle already in April, when the yield of the 10-year note started to head back up again.

In December 1967, inflation re-accelerated, forcing the Federal Reserve to enact another rate hiking cycle. As a result, the economy fell into a recession (more precisely, into a stagflation) in December 1969. We may be about to live through a similar mistake, unless there’s a more sinister plan in play.

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.