Recent trends in the banking sector.

Forecast of the loan portfolio.

Just a friendly reminder, our summer discount offer expires tomorrow. You can find the direct link to the offer here: https://gnseconomics.substack.com/f88ad619

This week we get a glimpse of the state of the U.S. banking system and also aim to improve our forecasts on the future lending path.

Banks are on a strategic trajectory

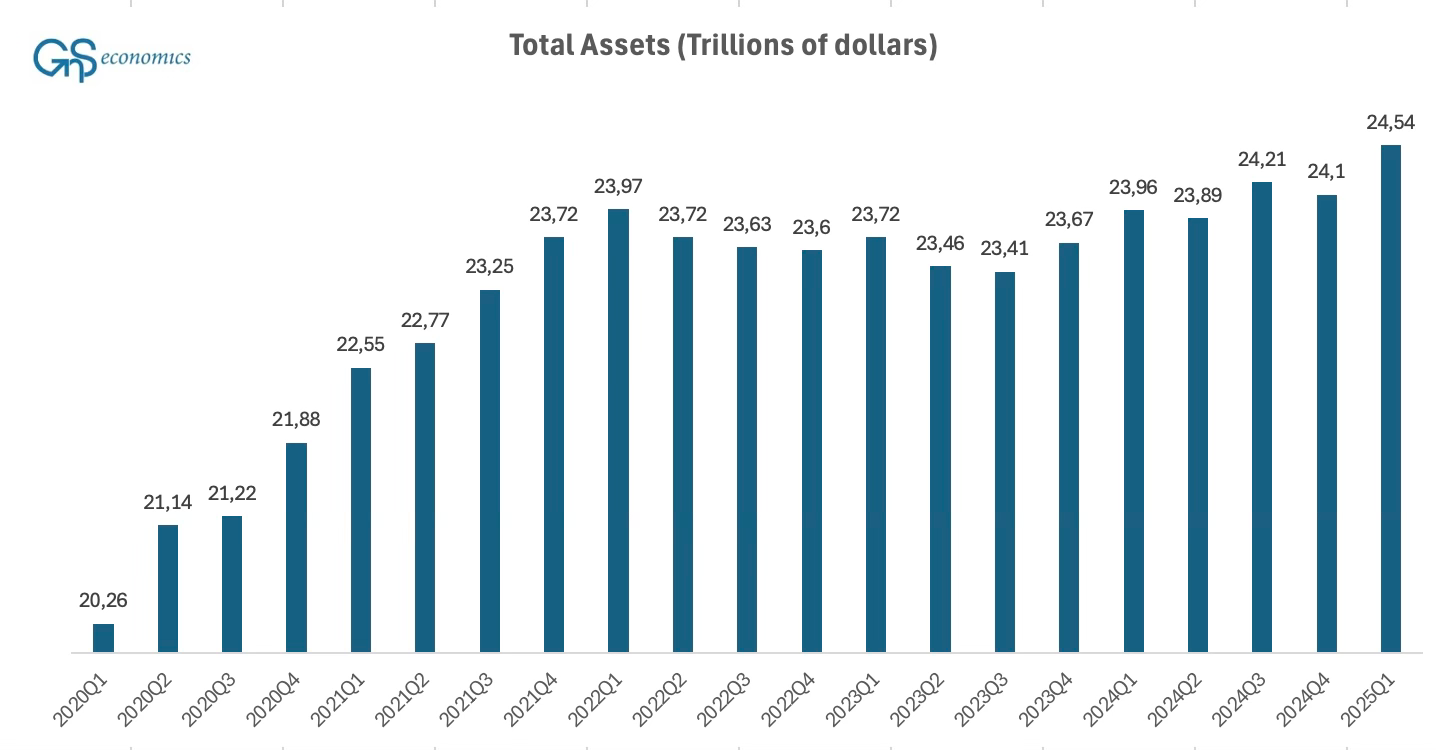

According to the latest Call Reports published by the FDIC, in the first quarter of 2025 the banking sector grew its total assets to 24.54 trillion dollars, marking an impressive quarterly increase of 437 billion dollars. This asset growth stands out as the largest recorded since the Federal Reserve began raising interest rates. This is how the sector’s assets have evolved since the COVID period.

What fueled this growth? If we decompose assets into categories, this is how it looks:

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.