Forecasts

Fed keeps its stand, for now.

Impulse response analysis of the new variables.

Forecasting inflation.

June has been a hectic month so far. May inflation data was released, the Federal Reserve held its meeting to decide on the federal funds rate. Conflicts are on the rise, the deadline on tariffs are closer each day and even the Fed cannot strongly see the future inflation trajectory. Despite this, we aim to update our inflation forecast with a more sophisticated approach.

Hold the rates

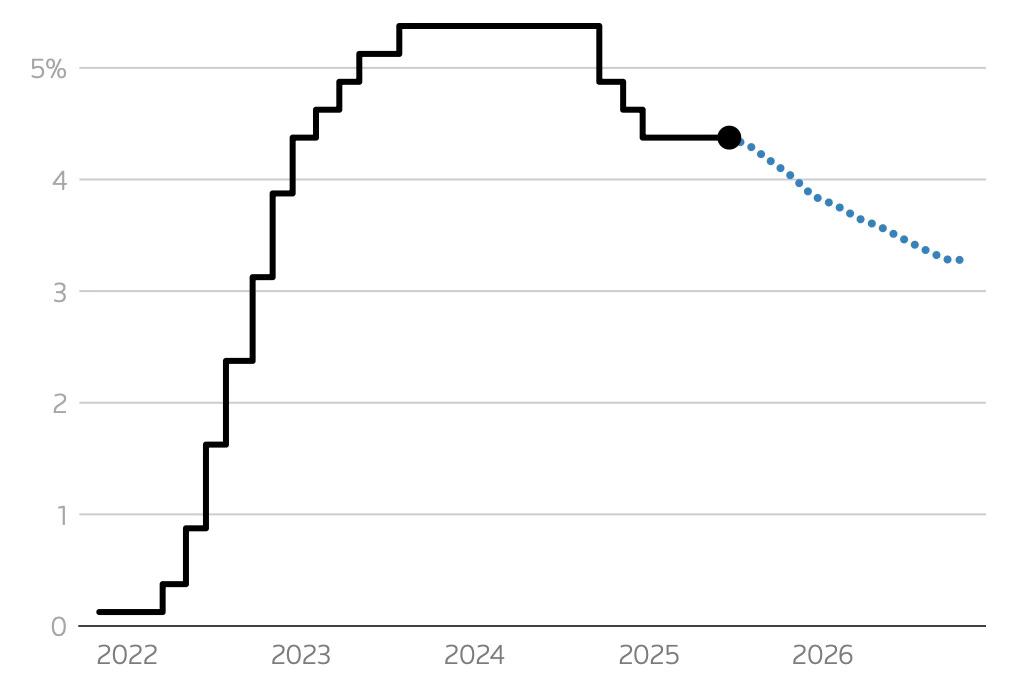

As widely expected, on Wednesday, the Federal Reserve kept its rate steady at the 4.25-4.5% level. This is the 5th hold out of the 8 meetings in the past year. This decision comes as no surprise, given the geopolitical tensions and the fears of tariffs could reignite inflation, which sure is the last thing the FED wants. They also showed that inflation is their main fear, instead of slowing growth. Their main economic projections are that both inflation and unemployment rise, while growth will decline. On the tariffs side, it is evident to wait. Only when they are fully active, starting at July 9, we will know the real economic impact it causes. After that, we will se how it manifests in inflation.

On the bright side, they hinted potential cuts this year, although on the condition of the state of given situations. We definitely have to see some real move in the right direction, before we expect any rate cuts.

Looking at the futures, market expectations regarding the federal funds rate is showing an interesting outlook.

At this stage, market expects the rate dipping below 4% shortly before the end of the year, and standing at around 3.5-3.75% at 2026 March.

But in the end, it all depends on how inflation behaves.

Impulse Analysis

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.