Today, credit rating agency Fitch downgraded the U.S. sovereign debt from AAA to AA+. This naturally caused an uproar from the Biden Administration, with a senior official calling it “bizarre”. However, the Fitch has a valid point behind its downgrade. It says in its statement that:

The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to 'AA' and 'AAA' rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.

You really cannot discredit any of these arguments.

The debt boom

In the first quarter of 2023, economic indicators pointed to an escalating concern regarding a potential U.S. default. The situation came under scrutiny, when the Treasury Secretary Janet Yellen highlighted the imminent risk of default, if there will be no adjustments to the national debt ceiling.

Historical data shows that the U.S. federal government had amassed a debt load of $20 trillion up to 2010, while the subsequent seven years saw an addition of $10 trillion. At early 2023, the U.S. federal debt stood at a staggering $32 trillion! After the Congress agreed to raise the debt limit, federal debt surged by $1 trillion in a month, suggesting that the U.S. national debt is currently growing at an exponential manner.

The Total Federal Debt in relation to the GDP shows that after peaking during Covid, it has yet to fall back to pre-pandemic levels. The sudden collapse of GDP, due to lockdowns, contributed to the major spike in the ratio in 2020-2021, but the fact remains that Corona years caused a major and permanent increase in the debt-to-GDP ratio of the U.S.

The (worrying) debt composition

Another crucial issue is the maturity structure of U.S. federal debt; approximately 45% of it matures within 0-2 years, 25% in 2-5 years, 15% in 5-10 years, 15% in 10-30 years, and basically 0% in 30(+) years. Considering some other major economies, like Germany and France, only around 20% of their sovereign debt will mature in 0-2 years, while having a more equally distributed maturity profile.

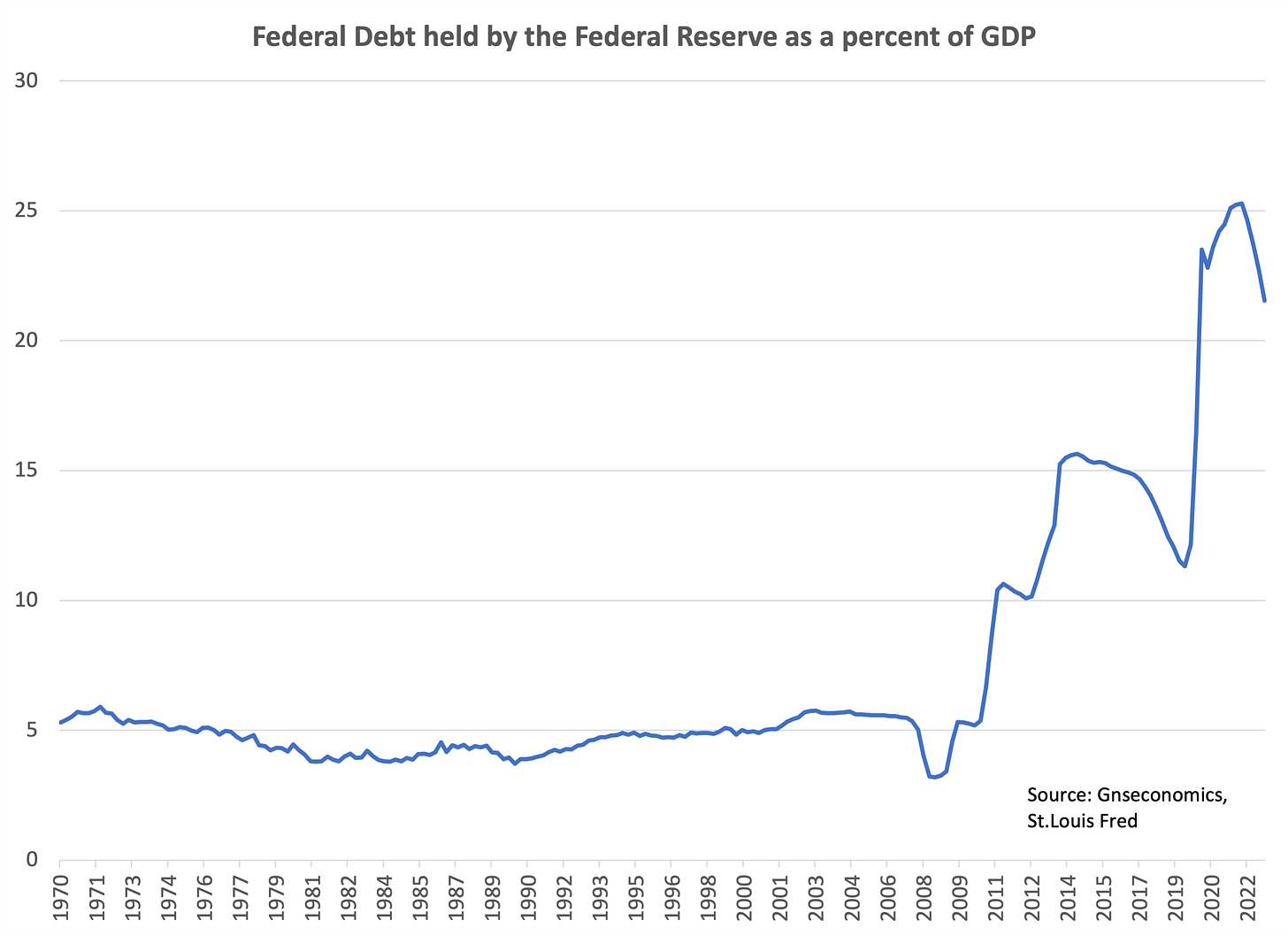

A key player in the U.S. federal debt saga is, somewhat unsurprisingly, the Federal Reserve, with its stake of around 20% of all government debt instruments. The surge in this percentage over recent years illustrates the pivotal role the Fed has assumed to stabilize the financial system. Essentially, it shows how aggressively the Fed had to step in after the 2008 financial crisis and during the Corona-shock in the spring 2020 to prevent a likely existential stress hitting the U.S. sovereign debt market.

What comes to the Fed, there is one question above others. How independent the central bank actually currently is, considering it holds a lion’s share of the debt of the federal government, which provides its powers? We have to remember that central banks are only quasi-independent, with national parliaments holding the power to audit them or even wound them down, at will.

Implications

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.