From Tuomas Malinen on Geopolitics and the Economy.

Issues discussed:

The collapse of the shadow banking sector leading into the Great Financial Crisis (GFC) in 2007-2008.

The bailout of the financial sector.

The imminent aftermath of the GFC.

I will now continue the mini-series on the Great Financial Crisis. Earlier, I wrote that this would be a two-part series and that I would publish both entries during the Holidays. However, there will now be at least three entries. This second one got delayed just because of the work-load during the Holidays. My apologies.

I lived through the GFC as a PhD student at the University of Helsinki. It was the most intriguing time of my studies. Especially the fateful fall of 2008 taught me more about economics, and the financial system, than all my econ studies combined. That is why I told my students, e.g., during the euro-crisis (2012), an offspring of the GFC, to stop what they’re doing and follow the crisis.

In addition of being great teachers to economics students, financial crises are fearsome creatures bringing economic hardships and suffering. But they also shed light to things in our economies and financial systems that do not work and/or need improvement. If we heed those warnings, our economies will turn more robust, making us more wealthy. With the GFC this, most unfortunately, did not come to be. Most notably, the grip of authorities on our financial system, and economies, has become more and more pervasive ever since.

For quite some time, I lived under the fallacy that authorities were there to make our financial systems safer. Like I explained in the first entry, I don’t think this holds true anymore, regardless whether the motives of authorities are truly benevolent, or not. They mess up, and make things worse by trying to regulate more. I explained in the first entry, how mistakes and outright corruption of authorities were the main culprits why the GFC got so bad, and just recently authorities nurtured another crisis, the Global Financial Crisis of 2022- . Also this time around authorities, especially central bankers, over-did themselves, and we are yet to see the full costs of their indiscretion.

But, now to the main issue, i.e., how the Panic of 2008 proceeded and how it was handled? If you have not, I urge you to check the first part of the series before starting this.

Into the GFC

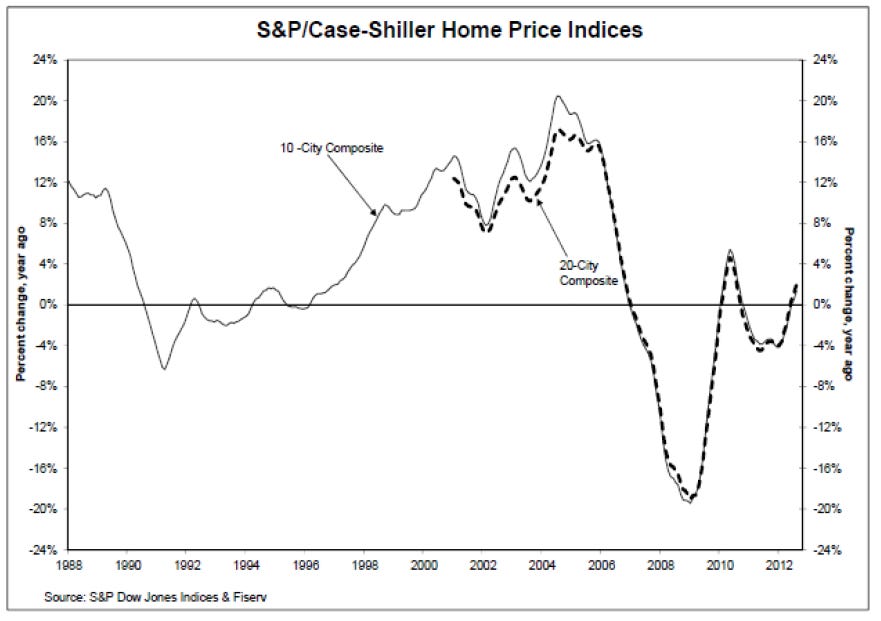

In late Spring of 2006, the US housing market boom started to sour. In early 2006, the interest free period of many mortgages ended. Prices started falter and then fall. Yet, they had accomplished a stellar rise. By 2006, according to the S&P Case-Shiller 20-City Composite Home Price Index, prices had risen by astonishing 106 percentage points from 2000. From their peak in April 2006 to bottom in May 2009, prices dropped by 40 percentage points. It was a classical boom-and-bust cycle, but with exceptionally dire consequences.

Falling prices led to rapidly growing loan defaults almost immediately. Because the housing market had developed into an effective Ponzi, speculators (including ordinary households) were ‘under water’ very quickly. Their debt levels surpassed the falling value of houses and fire sales ensued. The narrative told prior the crisis that the U.S. housing market “would never fall” failed many. Entire areas of houses were abandoned, which led to further price decreases, to further defaults, to growing abandonment of houses and to further price decreases. A systematic, clustering cycle of price falls developed. Banks had assumed that the loan losses would not become systemic, but this was utterly broken by the clustering nature of the mortgage failures pushing the distribution of losses into "the tails" of the normal distribution assumed by the VaRs (see my previous entry).

The collapse

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.