I am going to continue on from where I left off on Tuesday. I am going to explain in more detail what a sovereign debt crisis means. In Tuesday’s piece, I noted that

Sovereign debt crisis means the inability or unwillingness of a government to pay back the principal + interest of the debt (bonds) it owes to domestic and/or foreign investors, i.e., default. Domestic sovereign default implies default on a debt held by domestic bondholders, while external or foreign default implies default on the foreign holders of government bonds.

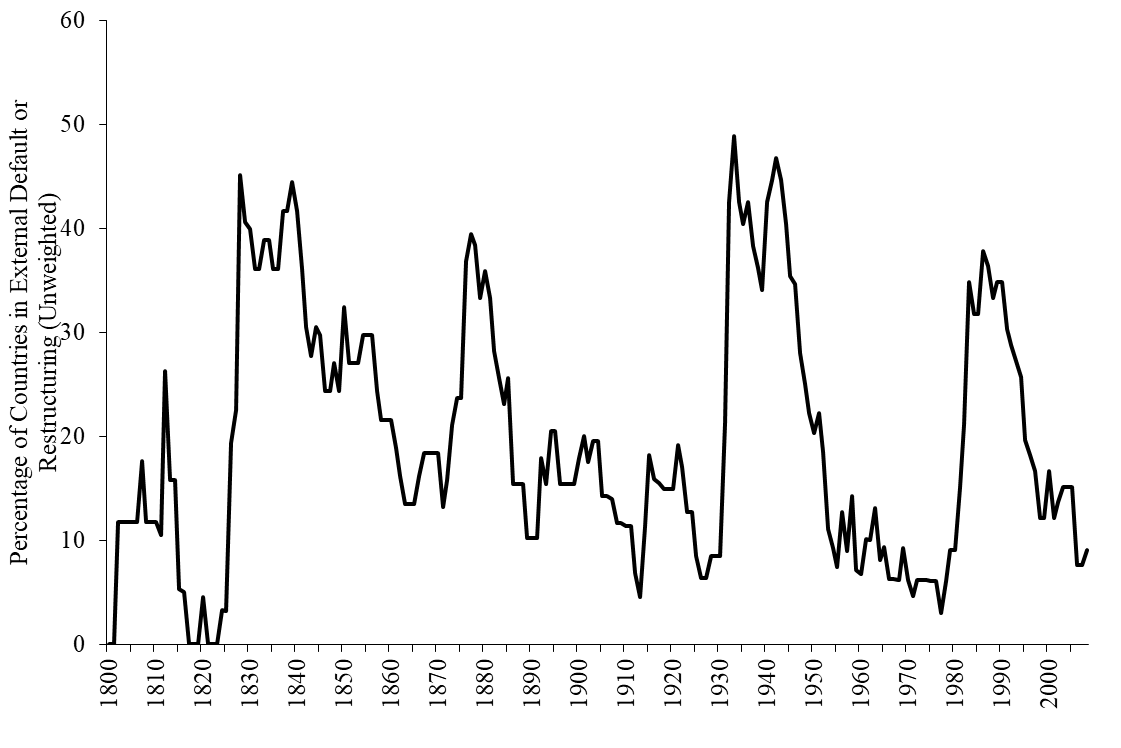

I also presented a figure from This Time Is Different by Carmen Reinhart and Kenneth Rogoff, which presents the share of countries in either external default or debt restructuring.

Extending the concept a bit, a fiscal crisis can be identified by four criteria (see, e.g., Kerstin Gerling et al.):

Credit event (foreign default).

Exceptional official financing (IMF).

Implicit domestic default (monetization, domestic arrears).

Loss of market access.

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.