From Tuomas Malinen on Geopolitics and the Economy.

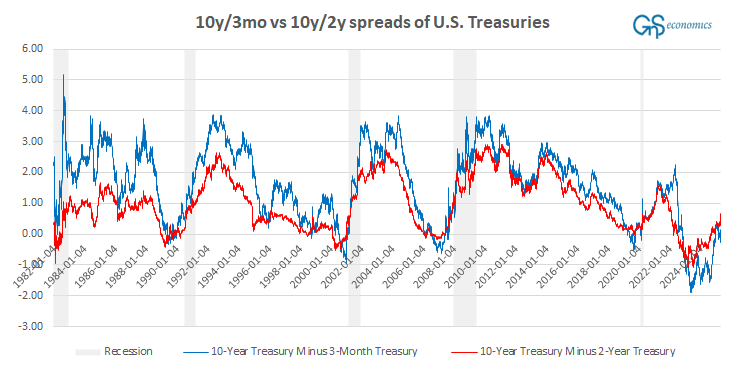

We now have a clear un-inversion of the spread of yields of 10-year/2-year U.S. Treasury notes (the yield-curve). We are also at a zig-zagging phase with the 10-year/3-month spread, which has always preceded recessions

What about the timing and implications for markets?

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.