From Tuomas Malinen on Geopolitics and the Economy.

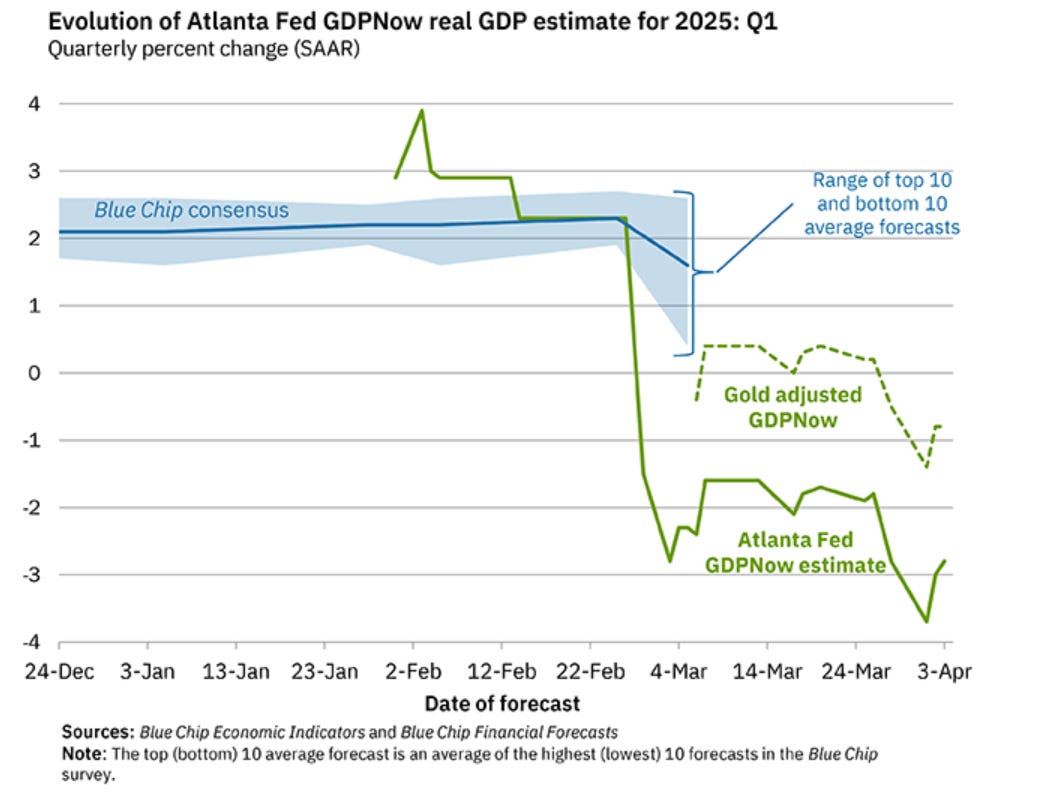

CEO of BlackRock, Larry Fink, stated yesterday that many CEOs think that the U.S. is already in a recession. This is the latest update to the nowcast of the Federal Reserve Bank of Atlanta. The “gold corrected” estimate now shows that the U.S. gross domestic product (GDP) would have fallen by 0.8% during the first quarter. This correction adjusts for the massive influx of gold into the U.S., which commenced at the end of February (after President Trump floated the idea of auditing Fort Knox).

The subcomponent graph gives more clarity about what’s going on.

The figure shows a massive negative impact of net exports, which is calculated as total exports minus total imports. I would argue that tariffs play a role here. That is, I argue that corporations have been front-loading their purchases from abroad to avert the effect of tariffs. Mish Shedlock did some excellent analysis on the subject a month ago, which I urge you to check.

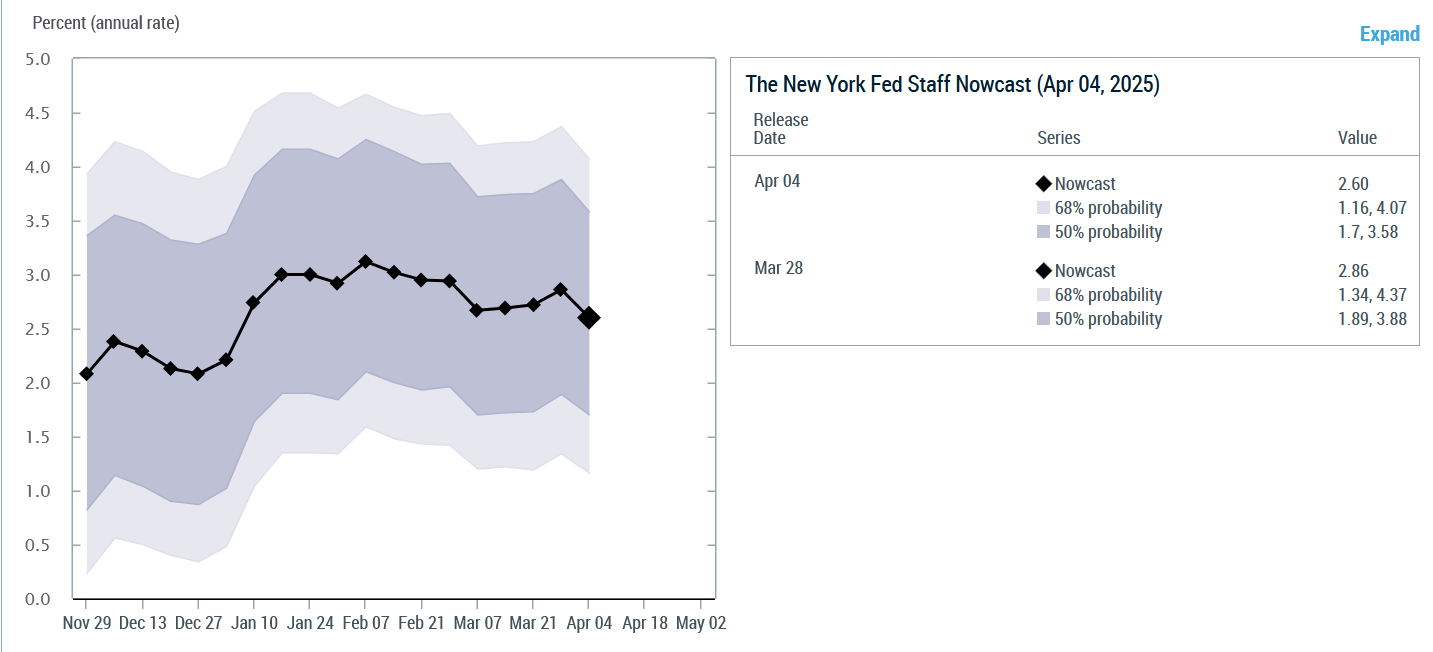

Still, something continues to be seriously “off” with the nowcasts. Here are some examples showing much more positive figures.

Our own nowcasting model, which incorporates the Atlanta Fed Nowcast, now indicates that the U.S. economy would have shrunk by 0.1% during the first quarter.

I think that all forecasting models are at a loss now due to both the massive stimulus that ran from 2020 till early 2025 and the tariffs (+ gold imports). The former biased the traditional business and economic linkages within the models, and the latter delivered a shock the models or the modelers have no prior knowledge of.

All time-series forecasting models rely on historical linkages between different variables to estimate the future path of, e.g., the GDP. If this is altered in some radical way (lockdowns, never-before-seen fiscal stimulus, and/or tariffs), the range of (statistical) forecasting error grows massively. This is mostly because the models are effectively trying to guess the future mean (average) of the series, and if the historical mean suddenly jumps a lot, models become uncertain on the future path of the mean. This presents itself as wide confidence intervals (error margins) of the forecasts. You can find a lengthier explanation here.

As a last notion, the 10-year/3-month yield curve (spread) has entered a clear reinversion. As we noted in Weekly Forecasts 12/2025, this is a notable recession signal, after which recession has always followed within the next two quarters.

I am starting to think the U.S. CEOs may be correct. Yet, I’ve considered the U.S. private sector to be in a recession since May.

Recessio oeconomica,

Tuomas

Disclaimer:

The information contained herein is current as of the date of this entry. The information presented here is considered reliable, but its accuracy is not guaranteed. Changes may occur in the circumstances after the date of this entry, and the information contained in this post may not hold true in the future.

No information contained in this entry should be construed as investment advice nor advice on the safety of banks. GnS Economics nor Tuomas Malinen cannot be held responsible for errors or omissions in the data presented. Readers should always consult their own personal financial or investment advisor before making any investment decision or decision on banks they hold their money in. Readers using this post do so solely at their own risk.

Readers must make an independent assessment of the risks involved and of the legal, tax, business, financial, or other consequences of their actions. GnS Economics nor Tuomas Malinen cannot be held i) responsible for any decision taken, act or omission; or ii) liable for damages caused by such measures.