From Tuomas Malinen’s Forecasting Newsletter

Let’s start with a recession update. The St. Louis Fed nowcast for U.S. gross domestic product growth in Q2 has fallen to negative. On the other hand, the GDP-now forecast of the Federal Reserve Bank of Atlanta shows a robust 2.9% (annualized) growth for the second quarter. The picture is thus rather mixed, which is no surprise.

The U.S. economy has shown some remarkable leniency under the weight of the record-breaking hiking cycle of the Federal Reserve. To be honest, though, without the extraordinary support to the banking system from the U.S. authorities since the failure of the Silicon Valley Bank, the U.S. would most likely be in a recession already.

I went through a barrage of economic crises during the 10 years I studied them in the academia, and I would hope that people, and analysts, would understand that the measures taken by the authorities to uphold the financial system during past five years have been far from normal. Their exceptionality shows how dire the situation in the financial sector has become. What worries me the most is the general rule that can be drawn from the history of crises: the more aggressive means you have to use to postpone the crisis, the deeper it will eventually be.

Essentially, we (the world) have been drifting towards either a crisis of epic proportions or a takeover of our economies by the authorities, since 2018 when the central banks started their efforts to dimish their balance sheets through the programs of quantitative tightening, or QT. The first effort tor raise rates after a decade of extremely low interest rates ended to the near-collapse of U.S. credit markets in early January 2019. The first-ever effort to diminish the balance sheet of the Fed ended to the near-implosion of the repo-markets in mid-September 2019.

So, the first QT-attempt of the Fed led to the near-collapse of the U.S. financial plumbing (repo-markets), while the second attempt led to the near-collapse of the regional banking sector. If the Fed is able to continue shrinking its balance sheet, which it not guaranteed with banks gorging loans from the Bank Term Funding Program, it’s a complete mystery how much further the balance sheet can fall before something blows up, again.

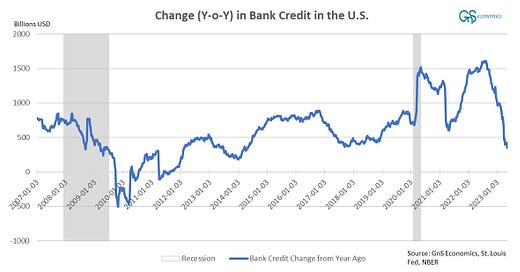

However, the big question now is, what is the situation with bank lending? We will dwell more on this topic in our Deprcon Special Issue published next week, but I am going to open our analysis by going through some lending data from the U.S.

Bank credit on the way down

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.