GDP growth forecast update

A likely rebound in Q2 (also in the markets), but what then? (Free)

I decided to update our gross domestic product (GDP) growth forecasts for the following four quarters. Remember, these are quarter-to-quarter figures, whereas the U.S. typically presents its GDP growth in annualized rates (also my mistake previously). You can get Y-to-Y simply by multiplying the figures presented in the table below by four. So, we forecast that the U.S. economy would grow at a 2% annual rate during this quarter.

Our nowcasts are now quite in line with those of the Atlanta Federal Reserve. Their latest nowcasts indicate that the U.S. economy will grow by 2.2% this quarter. The New York Fed forecasts that the U.S. economy will grow by 2.3%, while the St. Louis Fed has yet to publish their first estimate for Q2.

A rebound in the U.S. Q2 GDP growth is expected because the trade imbalance (deficit) is expected to recover from tariff frontloading, i.e., households and corporations buying what they need for the short term before tariffs kick in fully. As President Trump enacted yet another tariff pause lasting until July, the front-loading may also continue for this quarter. This also shows in the notable increase of the gross domestic private investments, which include private fixed investments and private inventories. It is thus possible that the massive trade imbalance will continue to deepen for a short while longer. This would continue to affect the nowcasts negatively (because imports exceeding exports will have a negative effect on the GDP).

The undercurrents below the U.S. economy are deeply recessionary, like I noted on the 30th of April. Alas, if the trade-war deepens in Q3, with tariffs taking full effect in July, and if nothing drastic happens (like the DOGE stimulus checks), we can expect the U.S., and global, recession to commence either during Q3 or Q4.

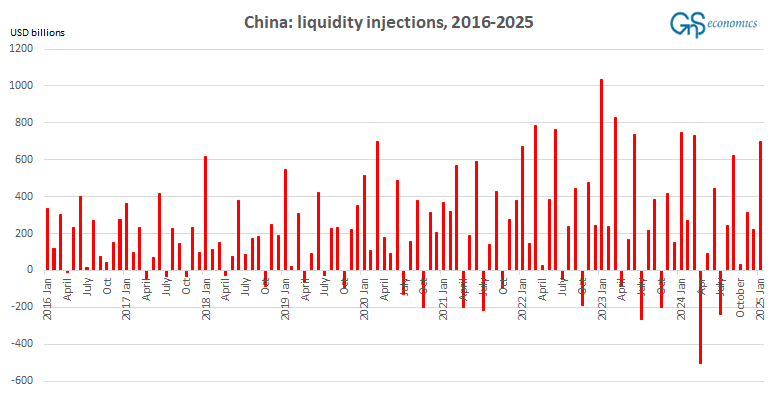

Historically, liquidity injections from China have come to support the markets at the end of May, continuing until early July. We may thus enter a strong rally at the end of May, which could continue till the end of June (at least).

However, uncertainties concerning the market outlook continue to be massive, which is why simple liquidity may not be enough to push the markets into a rally. I will return to this next week.

Tuomas

Disclaimer:

The information contained herein is current as of the date of this entry. The information presented here is considered reliable, but its accuracy is not guaranteed. Changes may occur in the circumstances after the date of this entry, and the information contained in this post may not hold true in the future.

No information contained in this entry should be construed as investment advice nor advice on the safety of banks. Readers should always consult their own personal financial or investment advisor before making any investment decision or decision on banks they hold their money in. Readers using this post do so solely at their own risk. GnS Economics, any of its partners and employees, nor Tuomas Malinen cannot be held responsible for errors or omissions in the data presented.

Readers must make an independent assessment of the risks involved and of the legal, tax, business, financial, or other consequences of their actions. GnS Economics nor Tuomas Malinen or any other authors cannot be held i) responsible for any decision taken, act or omission; or ii) liable for damages caused by such measures.

Fixed investments consist of purchases of residential and nonresidential structures, equipment and intellectual property products by private businesses, by nonprofit institutions, and by governments in the United States, while private inventories consist of the change in the physical volume of inventories owned by private business, valued at the average prices of the period.