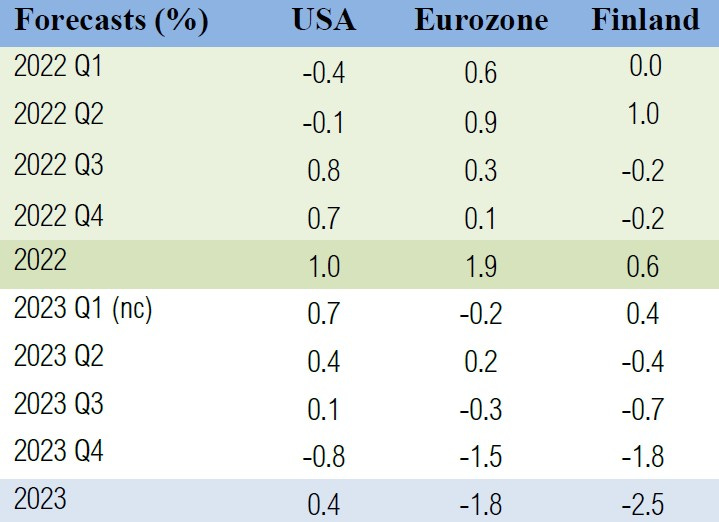

Forecasts

(GnS Economics, OECD, Q-to-Q). 2022 ended with a positive note for the U.S. and Eurozone economies, but Finland slipped into a (technical) recession with two consecutive quarters of negative GDP growth. Our nowcasts indicate that the U.S. economy would keep its good momentum during this quarter, while the Eurozone would see a negative GDP growth print. Our nowcasts indicate that the Finnish economy would, briefly, return to growth

We have updated our recessions forecasts based on the data gathered to this Special Issue and they have led us to postpone our prediction on the onset of an U.S. recession till Q3/Q4 this year. This has also changed our Deprcon indexes, with the U.S. value rising to three and that of the Eurozone to two. However, uncertainties are currently very high, which are discussed in the end of the outlook.

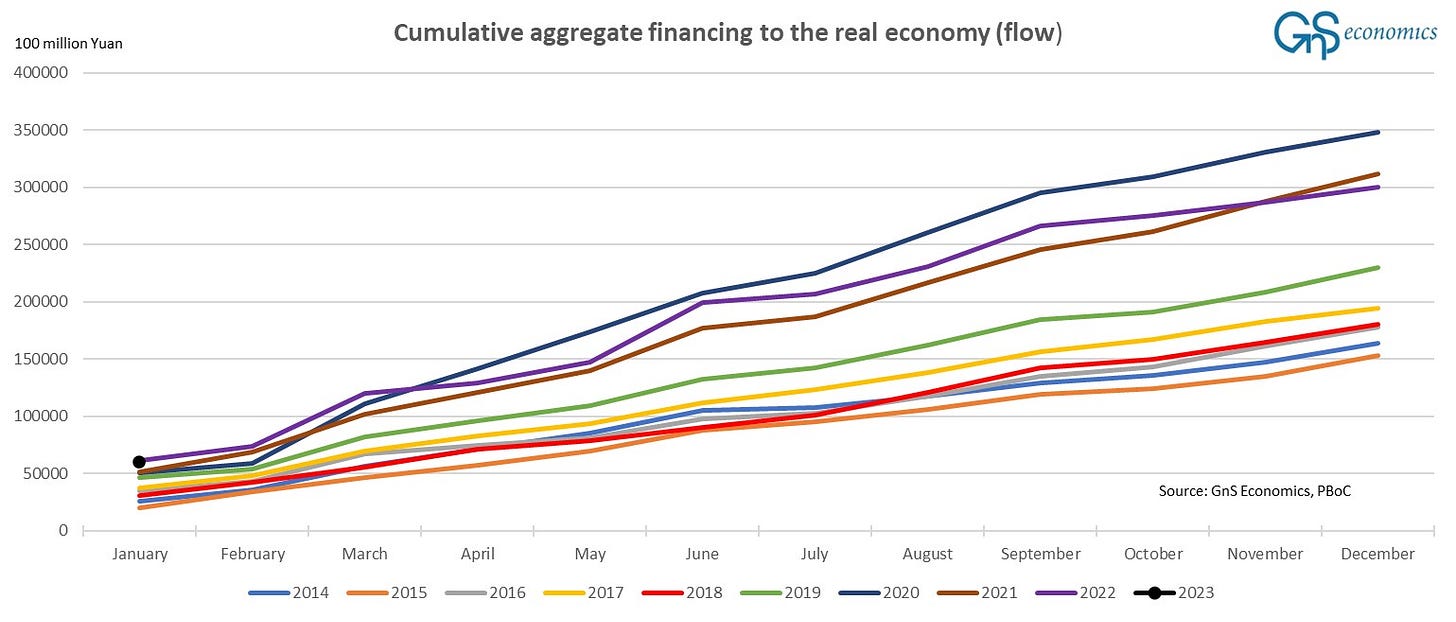

China stimulus

The aggregate financing to the real economy started the year with a notable RMB5.98 trillion, which was just RMB195.9 billion less than the record, RMB6.17 trillion, set in January 2022. This will give a boost to the world economy in around May, but first we have to go through the year-end slump in Chinese aggregate financing which will come visible in economic indicators next month.

Global liquidity (forthcoming)

We are in the process of constructing a global liquidity database tracking and forecasting the global market liquidity 2-3 months ahead. We expect to publish a preliminary version of it in April.

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.