Publication delayed due to illness.

Europe is in a recession, albeit it’s not clearly visible in the GDP figures yet. Thus, China and the U.S. are effectively ‘carrying the torch’ for the global economy. We can argue that the continued expansion of their respectful economies is the only thing standing between the current economic prosperity and the abyss the world economy is about to get sucked into.

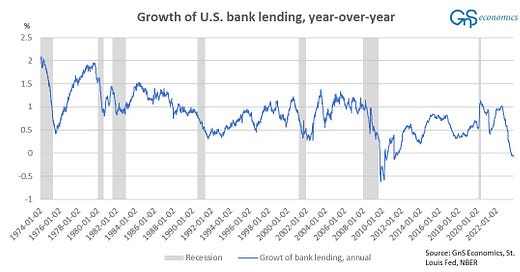

In this report, we update the situation in the U.S. economy, recession-wise, and find that a credit crunch has begun. We also provide an analysis on the recent developments in China concentrating on the collapsing real estate sector.

First, we provide GDP growth forecasts in a scenario, where we assume that the conflict between Israel and Hamas does not escalate into a regional war. However, at current time, the likelihood of such a scenario is diminishing rapidly, even though it’s still the most likely one. War in the Middle East has the capacity to deliver a devastating blow to the fragile global economy, which is why Tuomas will continue formulating the worst-case scenario in his newsletter, reprinted to our subscribers.

GDP Forecasts

(GnS Economics, OECD, Q-to-Q). The U.S. gross domestic product beat (most) expectations by growing 4.9% (annualized) in Q3, according to the first estimate. It turns out that our last estimate for it was a bit too optimistic after all. At the end of September we ‘nowcasted’ that the U.S. GDP would grow by 1.4% Q-to-Q (5.6% annualized) in Q3. While too optimistic, we at least erred to the correct (positive) side, while many analysts expected growth to slow from Q2.

All economic forecasts currently include an exceptional amount of uncertainty. This is because the spectrum of possible developments (scenarios) in the Middle-East carry highly differing implications for the world economy. Here, we provide estimates for GDP growth for a scenario, where there is no regional-wide escalation, which can be considered as the most likely one in current time.

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.