From Tuomas Malinen’s Forecasting Newsletter.

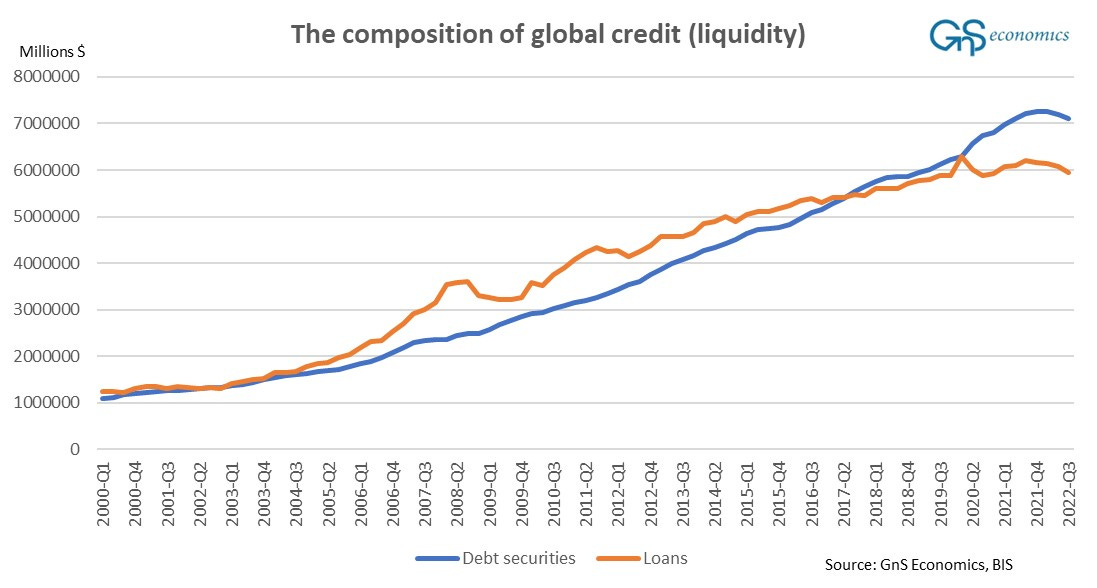

Global bank lending contracted deeply in Q3 implicating that we were at the verge of another banking crisis in early October. The issuance of debt securities also contracted notably driven in part by quantitative tightening, QT. Thus, it was no surprise that financial markets reacted as they did in September and October.

Like I noted in my previous entry, central banks and especially the People’s Bank of China (PBoC) raised the global liquidity and thus the markets from their depth in October and November.

For markets, the question is, how is global market liquidity going to develop in the near future? The combination of QT of the Federal Reserve and the European Central Bank (ECB) continues to be the ‘liquidity time-bomb’, but there are other notable factors at play which affect the timing of its “detonation”.

The ‘seasonality’ of the PBoC

When we observe the injections of money (liquidity) by China and the United States into the global financial system, we notice three important things.

Keep reading with a 7-day free trial

Subscribe to GnS Economics Newsletter to keep reading this post and get 7 days of free access to the full post archives.